9/23 0pip

9/24 0pip right now

I cannot entry at all.

Calender;

USD Core Durable goods order

USD New Home sale

EURUSD

the same strategy to yesterday trade

Long 1.3310-1.2390

TC 1.3370-90

LC 1.3260

Friday, September 24, 2010

Thursday, September 23, 2010

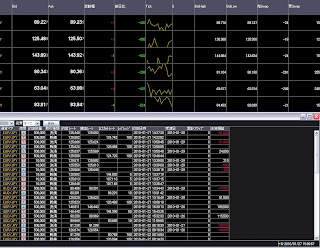

Forex for iPhone

http://www.youtube.com/watch?v=XEJ6Ht5F8Wk

Forex Trade is good broker with tight spread,

USDJPY 1.0pip

EURUSD 2.0

AUDJPY 2.0

yeah, of course, it has cash back after 5 trades, cash back amount is 3000yen.

http://www.forextrade.jp/

Most of Japanese brokers have tight spead and no margin fee.

but tax is high in Japan,,,

and this iPalmo is not bad app for forex,

but i cannot be satisfied with its chart, it shows only a few pair of indicators,,, although other compnay's apps are the same thing.

Forex Trade is good broker with tight spread,

USDJPY 1.0pip

EURUSD 2.0

AUDJPY 2.0

yeah, of course, it has cash back after 5 trades, cash back amount is 3000yen.

http://www.forextrade.jp/

Most of Japanese brokers have tight spead and no margin fee.

but tax is high in Japan,,,

and this iPalmo is not bad app for forex,

but i cannot be satisfied with its chart, it shows only a few pair of indicators,,, although other compnay's apps are the same thing.

9/23

9/22 +8pips

9/23 0 pips right now

Calender:

USD umemployment claim

USD Existing Home Sales

USD CB leading index

EURUSD:

Long 1.3375-1.3355

TC 1.3450-1.3480

LC 1.3300

it is gonna be resistance around 1.3500

I do not recomend to have short position but scalping trade.

9/23 0 pips right now

Calender:

USD umemployment claim

USD Existing Home Sales

USD CB leading index

EURUSD:

Long 1.3375-1.3355

TC 1.3450-1.3480

LC 1.3300

it is gonna be resistance around 1.3500

I do not recomend to have short position but scalping trade.

Wednesday, September 22, 2010

9/22

9/21 -22pips -2.8%

trading error

good risk management

today's clalender

no paticular events

EURUSD 1.3333 could be resistance,

in my opinion, it will looks like Double Top.

my stratedy:

Long 1.3265~1.3230 TC 1.3335~1.3380 LC 1.3180

Short 1.3333~1.3380 LC 1.34000

currentry +8pips right now.

my trade will be close if loss acheives -3%. That's trading rule #1

trading error

good risk management

today's clalender

no paticular events

EURUSD 1.3333 could be resistance,

in my opinion, it will looks like Double Top.

my stratedy:

Long 1.3265~1.3230 TC 1.3335~1.3380 LC 1.3180

Short 1.3333~1.3380 LC 1.34000

currentry +8pips right now.

my trade will be close if loss acheives -3%. That's trading rule #1

Tuesday, September 21, 2010

9/21 report

9/20 +16pips

9/21 +11pips right now

Calender:

Building permits 560,000

house starts 550000

FOMC 0.25%

USDJPY:

85.20-86.20

short 72% long 28% (8/20)

85.80-90 Short

TP 85.45-30

LC 86.35

EURUSD

short 49% long 51% (8-20)

1.3090-1.3115 Short

TP1.3025-1.2980

LC 1.3150

9/21 +11pips right now

Calender:

Building permits 560,000

house starts 550000

FOMC 0.25%

USDJPY:

85.20-86.20

short 72% long 28% (8/20)

85.80-90 Short

TP 85.45-30

LC 86.35

EURUSD

short 49% long 51% (8-20)

1.3090-1.3115 Short

TP1.3025-1.2980

LC 1.3150

9/20 report

Today is just +13pips...

It is better to forecast how much I am gonna lose pips when trade is loser than forecasting how much pips I get.

Tokyo market was close today, then market was slow.

tomorrow I will be cafefull for :

AUD Monetary Policy Meeting Minutes

USD FOMC statement http://www.youtube.com/watch?v=k0446s_IlzA&feature=player_embedded

USD Building permits & Housing starts http://www.youtube.com/watch?v=CnLGYlBVxnQ&feature=player_embedded

it will look good to post before NY market opens:

Forecast Range

Calender

Data

I will try to post those tomorrow.

It is better to forecast how much I am gonna lose pips when trade is loser than forecasting how much pips I get.

Tokyo market was close today, then market was slow.

tomorrow I will be cafefull for :

AUD Monetary Policy Meeting Minutes

USD FOMC statement http://www.youtube.com/watch?v=k0446s_IlzA&feature=player_embedded

USD Building permits & Housing starts http://www.youtube.com/watch?v=CnLGYlBVxnQ&feature=player_embedded

it will look good to post before NY market opens:

Forecast Range

Calender

Data

I will try to post those tomorrow.

Tuesday, August 17, 2010

Hindenburg Omen

Hidenburg Omen --- http://en.wikipedia.org/wiki/Hindenburg_Omen

Recently it is occured.

August 16, 2010: Another unconfirmed Hindenburg Omen occurred, but just barely, as 70 stocks hit new lows as per www.stockcharts.com. This day coincided with record low trade volumes for 2010.

August 12, 2010: An unconfirmed Hindenburg Omen occurred, the first since the market lows of 2009. One nearly occurred on August 11, failing only in that 67 stocks hit new lows, rather than the required 69.

but it is said that it is established 25%, then it is better to know Hindenburg Omen.

I bring umbralla when forecast say 25% chance of rain.

Recently it is occured.

August 16, 2010: Another unconfirmed Hindenburg Omen occurred, but just barely, as 70 stocks hit new lows as per www.stockcharts.com. This day coincided with record low trade volumes for 2010.

August 12, 2010: An unconfirmed Hindenburg Omen occurred, the first since the market lows of 2009. One nearly occurred on August 11, failing only in that 67 stocks hit new lows, rather than the required 69.

but it is said that it is established 25%, then it is better to know Hindenburg Omen.

I bring umbralla when forecast say 25% chance of rain.

Friday, July 30, 2010

Preparation for beginners: How to win trade?

How to win trade? that's most difficult question if you cannot win your trading, but that could be easiest question when you start to win your trading.

First, let's think what we need for trade.

1. Time - we need time to trade

2. Trading - we must have our trading system that works to make benefit.

3. Capital - we cannot trading without money.

then, those 3 are first basic stuffs for trade,

and let's think about what we have to do for those 3 basics.

1. Time - we have to schedule time for trade.

If you have another work and you are part time trader, you have to take a time for your work, then find free time for trade. It is better to make the same schedule everyday, market has trend each time, for example, forex market rise or drop sharply to make trend sometimes when London market is open.

If you are full time trader, just trade all day, no matter you trade swing trade and have enough time, it is better to watch market anytime, that would be nearest way to be success trader.

2. Trading - we have to have skill of trading, trading mental, and trading rules.

Skill of trading is absolutly trading system. if you do not have trading system that can make benefit, you just lose money.

Trading Mental is important, we have to think anything can be happened on market, and be cool anytime.

Trading Rule is required to have good trade, for exmpale, if you make Loss Cut Rule and always keep this rule, your trade is not fail at once when you loss. Next we need to know we have tomorrow everyday, if you lose, just study why you lose and rest until tomorrow, and be cool. Third, Market is always irregular and ramdom, then we need advantage of possility, and trading rule give us advantage if we can keep our own rule.

3. Capital - do not give up no matter you do not have money, everyone ( most of people ) have no money at first, I even started from only 2000USD DEC/2003!

When you start trading, you have to trade with your capital you can accept to lose all money. that's also trading mental to accept risk, if you cannot accept risk and cannot accept to lose all money for your trading, your trading would be difficult to work.

If you do not have money to trade, you have to work and earn money, do not care how much it is, for example. if you invest 500USD from your salary every month and if you win trade with 2% gain average every day, one year later your capital would be 50K USD, it means you earn 4000USD ~ 5000USD every month and save all for one year, so we do not have to be hurry up anytime, forget about money, just enjoy trade. :)

* I do not take any responsivity for your trade, please trade for your own risk and responsivity.

First, let's think what we need for trade.

1. Time - we need time to trade

2. Trading - we must have our trading system that works to make benefit.

3. Capital - we cannot trading without money.

then, those 3 are first basic stuffs for trade,

and let's think about what we have to do for those 3 basics.

1. Time - we have to schedule time for trade.

If you have another work and you are part time trader, you have to take a time for your work, then find free time for trade. It is better to make the same schedule everyday, market has trend each time, for example, forex market rise or drop sharply to make trend sometimes when London market is open.

If you are full time trader, just trade all day, no matter you trade swing trade and have enough time, it is better to watch market anytime, that would be nearest way to be success trader.

2. Trading - we have to have skill of trading, trading mental, and trading rules.

Skill of trading is absolutly trading system. if you do not have trading system that can make benefit, you just lose money.

Trading Mental is important, we have to think anything can be happened on market, and be cool anytime.

Trading Rule is required to have good trade, for exmpale, if you make Loss Cut Rule and always keep this rule, your trade is not fail at once when you loss. Next we need to know we have tomorrow everyday, if you lose, just study why you lose and rest until tomorrow, and be cool. Third, Market is always irregular and ramdom, then we need advantage of possility, and trading rule give us advantage if we can keep our own rule.

3. Capital - do not give up no matter you do not have money, everyone ( most of people ) have no money at first, I even started from only 2000USD DEC/2003!

When you start trading, you have to trade with your capital you can accept to lose all money. that's also trading mental to accept risk, if you cannot accept risk and cannot accept to lose all money for your trading, your trading would be difficult to work.

If you do not have money to trade, you have to work and earn money, do not care how much it is, for example. if you invest 500USD from your salary every month and if you win trade with 2% gain average every day, one year later your capital would be 50K USD, it means you earn 4000USD ~ 5000USD every month and save all for one year, so we do not have to be hurry up anytime, forget about money, just enjoy trade. :)

* I do not take any responsivity for your trade, please trade for your own risk and responsivity.

Wednesday, June 9, 2010

Trade Result (May 24th to June 8th)

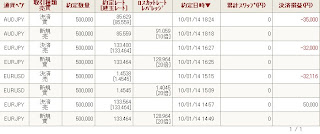

May 24th to June 8th (two weeks and two days)

46 trade = 38 Winners 8 Losers

+2030520 JPY

+13% gain

see you next month

46 trade = 38 Winners 8 Losers

+2030520 JPY

+13% gain

see you next month

Tuesday, June 8, 2010

6.8

1 trade 1 win +6.2pips +62000JPY

I did not sell Nikkei when it was 9900, I will sell when it is 12000. stop is 9300.

I did not sell Nikkei when it was 9900, I will sell when it is 12000. stop is 9300.

Friday, June 4, 2010

6.3

1 trade = 1 win = 7.5pips +75000JPY

it is not easy to trade nowadays, Kan will be next prime minister, and it will be upward trend, and you know I do not like to trade during trend.

it is not easy to trade nowadays, Kan will be next prime minister, and it will be upward trend, and you know I do not like to trade during trend.

Wednesday, June 2, 2010

Thursday, May 27, 2010

Nikkei and Euro...

Nikkei Long @ 9500

SL 9300

I see it is bottom for short term.

Germany, France, and etc, are not bad as greece, piigs counties, but price is down because of negative news about euro. News says about euro, then people see euro, but if it is down no matter it is good condition itself because of negative news of other neithers, this down is not real. then It will be right to buy Germany right now?

SL 9300

I see it is bottom for short term.

Germany, France, and etc, are not bad as greece, piigs counties, but price is down because of negative news about euro. News says about euro, then people see euro, but if it is down no matter it is good condition itself because of negative news of other neithers, this down is not real. then It will be right to buy Germany right now?

Wednesday, May 26, 2010

5.26

That was right to close all short position before index,

USDJPY was up to 90.45 just after index.

3 Trades = 2 Win + 1 draw = +9.5pips +95000 JPY

Tuesday, May 25, 2010

5.25

I do not trade during strong trend, it would be strong down trend right now, so I close today.

2Trade = 2 Win +12.6pips +126000

Monday, May 24, 2010

5.24

USDJPY 5 Trades 5 Win 0 Lose = JPY +416,850 +60.1pips

Stradedy was Short from the top, I ordered short at 90.40 to 90.50.

and I close trade before existing home sales 5.77M,

5 trade and 5 wins, +60.1 pips +413850yen

Saturday, May 22, 2010

Data USDJPY

[MA]

MA 21 92.755 -2.99%

MA 90 91.484 -1.64%

MA 200 91.108 -1.24%

[Envelope]

(+2%) 13 93.817

(-2%) 13 90.138

[Stochastic]

% D 13 35.49 middle

slow % D 47.01 middle

% D 42 35.46 middle

slow % D 47.00 middle

[RSI]

7 11.19 over sold

13 31.98 middle

[DMI]

PDI 14 4.55 sell

MDI 14 40.91

ADR 14 53.98 trend

ADXR 14 33.27 trend

[MACD trading method]

MACD -0.54 sell

Signal 9 -0.17

EMA12 91.79

EMA 26 92.33

[RC)]

14 -62.20%

[CB]

MAX 94.99 middle

MIN 87.94

[BB]

(+2σ) 20 95.63

(+1σ) 20 94.16

(-1σ) 20 91.23

(-2σ) 20 89.76

[ichimoku kinko hyo]

tenkan sen 9 91.30 gyakuten

kijunsen 26 91.47

senko span 1 (Today) 92.92 kumo no shita

senko span 2 (Today) 91.41

chiko span -9 89.98 yowaki

close price -26 92.11

currency data

[USDJPY]

S: 89.67

H: 90.49

L: 89.01

C: 89.98 ( +0.30 + 0.335% )

[EURJPY]

S: 111.99

H: 114.37

L: 111.01

C: 113.07 (1.06 0.946% )

[EURUSD]

S: 1.2486

H: 1.2673

L: 1.2454

C: 1.2568 (0.0080 0.641% )

[GBPUSD]

S: 1.4362

H: 1.4495

L: 1.4315

C: 1.4475 (0.0115 0.801% )

[USDCHF]

S: 1.1505

H: 1.1578

L: 1.1446

C: 1.1502 (-0.0009 -0.078% )

S: 89.67

H: 90.49

L: 89.01

C: 89.98 ( +0.30 + 0.335% )

[EURJPY]

S: 111.99

H: 114.37

L: 111.01

C: 113.07 (1.06 0.946% )

[EURUSD]

S: 1.2486

H: 1.2673

L: 1.2454

C: 1.2568 (0.0080 0.641% )

[GBPUSD]

S: 1.4362

H: 1.4495

L: 1.4315

C: 1.4475 (0.0115 0.801% )

[USDCHF]

S: 1.1505

H: 1.1578

L: 1.1446

C: 1.1502 (-0.0009 -0.078% )

Close Price of this week.

DOW→10193.39 +125.38

NASDAX→2229.04 +25.03

NASDAX→2229.04 +25.03

FT100→5062.93 -10.20

DAX→5829.25 -38.63

CME.N225→9840.00 +105.00

Gold →1176.10 -12.50

WTI→70.04 -0.76

USDJPY→90.0

EURUSD→1.257

GBPCHF→1.445

USDCHF→1.149

EURJPY→113.1

GBPJPY→130.0

CHFJPY→78.2

CADJPY→84.9

AUDJPY→74.9

NYDJPY→61.0

EURGBP→0.869

EURCHF→1.445

GBPCHF→1.662

AUDUSD→0.832

AUDNZD→1.226

CME.N225→9840.00 +105.00

Gold →1176.10 -12.50

WTI→70.04 -0.76

USDJPY→90.0

EURUSD→1.257

GBPCHF→1.445

USDCHF→1.149

EURJPY→113.1

GBPJPY→130.0

CHFJPY→78.2

CADJPY→84.9

AUDJPY→74.9

NYDJPY→61.0

EURGBP→0.869

EURCHF→1.445

GBPCHF→1.662

AUDUSD→0.832

AUDNZD→1.226

Wednesday, May 19, 2010

Day of Loser

-65 pips, today's loss date.

1. everything is opposite. (it was range. I misunderstood it.)

2. unlucky? (it became trend 30 sec after I stop trading. that's what I want)

1 and 2 are whatever...

3. risk management was well done.

4. I should close all positions ealier.

5. I should stop trading when it was -50pip total.

20 trading days a month. and how many days it should be loss & -pips days? it is rare 20 win 20 days,,, important thing is how much I can save loss when it is loss day.

1. everything is opposite. (it was range. I misunderstood it.)

2. unlucky? (it became trend 30 sec after I stop trading. that's what I want)

1 and 2 are whatever...

3. risk management was well done.

4. I should close all positions ealier.

5. I should stop trading when it was -50pip total.

20 trading days a month. and how many days it should be loss & -pips days? it is rare 20 win 20 days,,, important thing is how much I can save loss when it is loss day.

Monday, May 17, 2010

fx strength

AUD CAD resource county > JPY risk avoid > USD basic > EUR GBP worry

EURUSD down, EURJPY down

GBPUSD down, GBPJPY down

USD up

JPY up

JPY>AUD

JPYUSD down

JPY

JPYUSD up

88 to 95 range.

EURUSD down, EURJPY down

GBPUSD down, GBPJPY down

USD up

JPY up

JPY>AUD

JPYUSD down

JPY

JPYUSD up

88 to 95 range.

5.17

Let's see those points when market drop sharply:

1. 50% rules - we could buy EuroJpy by 113.50 level, 50% of 114.262 to 112.456. It was already achieved two hrs ago.

2. EURUSD moves after AUDUSD at New York market time.

1 is for daytrading, 2 is for scalping.

Nikkei: Nikkei was down -300 and I bought the dip again at 10180. close price is 10235 -226. my target is 10230, 50% rule for 10150 to 10320, and if dow is good today, TC is 10320, 50% of 10450 to 10150. let's see tomorrow.

EURO: I still think this is just about worry, and worry is worry, not brankrupt, it cannot be trigger, it can be cover. Euro is down trend, German will be graet power. it will be EUR=German, we could see bottom soon.

1. 50% rules - we could buy EuroJpy by 113.50 level, 50% of 114.262 to 112.456. It was already achieved two hrs ago.

2. EURUSD moves after AUDUSD at New York market time.

1 is for daytrading, 2 is for scalping.

Nikkei: Nikkei was down -300 and I bought the dip again at 10180. close price is 10235 -226. my target is 10230, 50% rule for 10150 to 10320, and if dow is good today, TC is 10320, 50% of 10450 to 10150. let's see tomorrow.

EURO: I still think this is just about worry, and worry is worry, not brankrupt, it cannot be trigger, it can be cover. Euro is down trend, German will be graet power. it will be EUR=German, we could see bottom soon.

Friday, May 14, 2010

5.14

I better comment in the blog, Facebook is not easy to see last comments I post, because we should do scroll down. Anyway, Today's strategy is not to trade Euro, if I trade, strategy would be trade the range in the box. And today's many USD index. so I would buy USD when it is down, US does not look bad as we can see USD is down right now,. so this might be timing to buy, but don't forget it is not best timing today so far, if today's index is bad, I recommend to cut loss soon.

USDJPY 91.75 - 93.25

AUDJPY 82.30 - 84.00

EURJPY 114.50 - 117.00

USDJPY 91.75 - 93.25

AUDJPY 82.30 - 84.00

EURJPY 114.50 - 117.00

5.13

RemoveYu Forex iphone 4G will be realse? How about Market 3G, Greece, Goldman Sachs, Goverment... what's the next G? German or GBP(British Pond) ?

Yesterday at 22:11 · Comment ·LikeUnlike · View feedback (4)Hide feedback (4)Dan Zawadka and 余潮泰 like this..Arya Pujasmara Ha haa..

Yesterday at 22:21 · .Shola Olaniregun the next G is German...

5 hours ago · .Write a comment....RemoveYu Forex and important thing is how to lose trade, not how to win trade. nowadays I never lose, but I missed chance twice, that's guilty more than losing. anyway I also lose many times, I am just lucky nowadays, professional traders have experience to lose more than amature traders, and they are good at managin for losing trade..., that's the one of big difference between winner and loser.See more

Yesterday at 21:14 · Comment ·LikeUnlike · View feedback (7)Hide feedback (7)余潮泰 and Afb Inter' Forex like this...Afb Inter' Forex lool trader knows how to profit, but didnt know how to manage their loss

Yesterday at 21:32 · .Yu Forex Right, you guys make a point, everyone knows how to profit, and then most of them see only profit and never see how to lose trade, accepting risk and managing risk are priority #1 to get start on trading.

Yesterday at 21:34 · .Write a comment....RemoveYu Forex ok, and how to win trade,,, I can say I really do not have idea, I just sell when other traders still buy, I buy when other traders still sell, my timing seems to be really differnt from other traders, and how to get timing and sense of trading? that's trial and error.

Yesterday at 21:11 · Comment ·LikeUnlike · View feedback (2)Hide feedback (2)Arya Pujasmara I know you're the great trader...i know it yu...go on bro..

Yesterday at 21:58 · .Yu Forex thank you

Yesterday at 22:06 · .Write a comment....RemoveYu Forex many people have asked me the same kind of questions these days,,, that's how to win trade? ok... as you read my post, I have won all trade since last thuraday and got 597 pips and missed chance two times ( total +400pips...) because I am lazy. to be continue

Yesterday at 21:11 · Comment ·LikeUnlike · View feedback (9)Hide feedback (9)Czarina Cleopatra Mendoza likes this...Opeoluwa Opeyemi Oluwatimileyin Pls can you kindly expose our trading strategy ???

8 hours ago · .Yu Forex sell when it is overbought, buy when it is oversold. please read what i post before, you can check I trade like this.

6 hours ago · .Write a comment....RemoveYu Forex LOL, It was like the highest price AUDJPY at 84.48 when I wrote last post two hrs ago,,, of course, as I said last post, I was ready to sell when it was up trend, but I did not have short postion because i ate, but it is already down to 83.60 now. hahaha, how lazy trader I am... miss chance is guilty more than losing trade!!!

Yesterday at 18:22 · Comment ·LikeUnlike · View feedback (10)Hide feedback (10)Czarina Cleopatra Mendoza and Kaulah Yang Satu like this...Arya Pujasmara C'mon yu...a thousand chance is waiting for you...! Spirit guy... ;-)

Yesterday at 21:55 · .Yu Forex thanks, anyway missing change is not good for trader.

Yesterday at 22:06 · .Write a comment....RemoveYu Forex we know that AUD/JPY = GOLD, USD/JPY = DOW, also AUD/USD → EUR/USD when it is drop sharply. Today AUD is good number, and it is up trend, but I am ready to sell, AUD grows as we expected, it means it is almost perfect, the more it is closed to perfect, the more vol is short, then it will be fixed.

Yesterday at 15:35 · Comment ·LikeUnlike · View feedback (4)Hide feedback (4)El-Yamusa Fx Dalhat and Prince Travis Quinn Rupp like this..John Henry settlin another trappin, wuhuhuu rock on :D

Yesterday at 21:11 · .Yu Forex yeah, I post that 5hrs ago, and that's what AUDJPY happened after making highest price as I mention.,, and I missed chance to tarde, anyway ou are right, I already see next trade. :)

Yesterday at 21:31 ·

Yesterday at 22:11 · Comment ·LikeUnlike · View feedback (4)Hide feedback (4)Dan Zawadka and 余潮泰 like this..Arya Pujasmara Ha haa..

Yesterday at 22:21 · .Shola Olaniregun the next G is German...

5 hours ago · .Write a comment....RemoveYu Forex and important thing is how to lose trade, not how to win trade. nowadays I never lose, but I missed chance twice, that's guilty more than losing. anyway I also lose many times, I am just lucky nowadays, professional traders have experience to lose more than amature traders, and they are good at managin for losing trade..., that's the one of big difference between winner and loser.See more

Yesterday at 21:14 · Comment ·LikeUnlike · View feedback (7)Hide feedback (7)余潮泰 and Afb Inter' Forex like this...Afb Inter' Forex lool trader knows how to profit, but didnt know how to manage their loss

Yesterday at 21:32 · .Yu Forex Right, you guys make a point, everyone knows how to profit, and then most of them see only profit and never see how to lose trade, accepting risk and managing risk are priority #1 to get start on trading.

Yesterday at 21:34 · .Write a comment....RemoveYu Forex ok, and how to win trade,,, I can say I really do not have idea, I just sell when other traders still buy, I buy when other traders still sell, my timing seems to be really differnt from other traders, and how to get timing and sense of trading? that's trial and error.

Yesterday at 21:11 · Comment ·LikeUnlike · View feedback (2)Hide feedback (2)Arya Pujasmara I know you're the great trader...i know it yu...go on bro..

Yesterday at 21:58 · .Yu Forex thank you

Yesterday at 22:06 · .Write a comment....RemoveYu Forex many people have asked me the same kind of questions these days,,, that's how to win trade? ok... as you read my post, I have won all trade since last thuraday and got 597 pips and missed chance two times ( total +400pips...) because I am lazy. to be continue

Yesterday at 21:11 · Comment ·LikeUnlike · View feedback (9)Hide feedback (9)Czarina Cleopatra Mendoza likes this...Opeoluwa Opeyemi Oluwatimileyin Pls can you kindly expose our trading strategy ???

8 hours ago · .Yu Forex sell when it is overbought, buy when it is oversold. please read what i post before, you can check I trade like this.

6 hours ago · .Write a comment....RemoveYu Forex LOL, It was like the highest price AUDJPY at 84.48 when I wrote last post two hrs ago,,, of course, as I said last post, I was ready to sell when it was up trend, but I did not have short postion because i ate, but it is already down to 83.60 now. hahaha, how lazy trader I am... miss chance is guilty more than losing trade!!!

Yesterday at 18:22 · Comment ·LikeUnlike · View feedback (10)Hide feedback (10)Czarina Cleopatra Mendoza and Kaulah Yang Satu like this...Arya Pujasmara C'mon yu...a thousand chance is waiting for you...! Spirit guy... ;-)

Yesterday at 21:55 · .Yu Forex thanks, anyway missing change is not good for trader.

Yesterday at 22:06 · .Write a comment....RemoveYu Forex we know that AUD/JPY = GOLD, USD/JPY = DOW, also AUD/USD → EUR/USD when it is drop sharply. Today AUD is good number, and it is up trend, but I am ready to sell, AUD grows as we expected, it means it is almost perfect, the more it is closed to perfect, the more vol is short, then it will be fixed.

Yesterday at 15:35 · Comment ·LikeUnlike · View feedback (4)Hide feedback (4)El-Yamusa Fx Dalhat and Prince Travis Quinn Rupp like this..John Henry settlin another trappin, wuhuhuu rock on :D

Yesterday at 21:11 · .Yu Forex yeah, I post that 5hrs ago, and that's what AUDJPY happened after making highest price as I mention.,, and I missed chance to tarde, anyway ou are right, I already see next trade. :)

Yesterday at 21:31 ·

Thursday, May 13, 2010

commetn on facebook 5.12

Yu Forex lol, that's scary everythihng is correct what I guess. EUR was right to buy on the dip, Gold was right to see USD is weak and eur is up now. EURJPY is 118.37 now, I already took profit at 118.00. +110pips.

Yesterday at 17:46 · Comment ·UnlikeLike · View feedback (14)Hide feedback (14)You, 余潮泰, Anthony Lim and 2 others like this..余潮泰 This is wat we call pro!!!

Yesterday at 20:14 · .Komelisa Wardi 110 pips is really something. i'm interested to know what system are u using yu? f.a, technical..or both?thanks.

Yesterday at 20:35 · .Aaron Zutler Was a nice pivot point play. MACD divergence @ daily pivot point S1 .. Went straight up to PP @ 118.

Yesterday at 22:12 · .Yu Forex thank you, all. :) please see what I post before trading euro, we could see euro and england had index a lot today, and we could guess euro is good itself except pigs, and German will have great power in euro to asist greece this time. Today euro was down when I thought about long position at 116 level, market seems to agree this time asistance for...

See more

greece, but euro was too low, and we could see range was 116 to 118... I thought euro was too low, and it would make bottble bottom, and I checked eurojpy made bottom at 116.50, then it was up to 116.80 to 90, so I could see timing to buy the dip, and target was highest price at new york time yesterday, that's 118.50 line, but I am enough at 118.00, so my TC was 118.00. I trade with both fundamental and technical like this, and I see indicator, MACD, CCI, MA Indi, etc, but I never follow indicators like golden cross and etc, I just check how they go.

12 hours ago · .Vipul Met 1 Advice-Don't change, 1 request-take care, 1 wish-Don't forget me, 1 Lie-I hate U, 1 truth-I Miss U, 1 hope-We'll always be Gud Friend.....

3 hours ago · .Yu Forex ???

3 hours ago · .Vipul Met HA HA

2 hours ago · .Mohd Nizam hye buddy..may i ask what system you use to trade..

i am nubie...

about an hour ago · .Yu Forex please read what I wrote, also I understand my english is bad. I use both fundamental and techonical, indi is macd, stoch, MA, cci, etc, but I never fiollow indicator liike golden cross. I just try to buy on the dip. :)

8 minutes ago · .Mohd Nizam hehehe tq....are you full time trade bro?

4 minutes ago · .Write a comment....RemoveYu Forex what is meaning Gold is up, HF seems to buy, it means USD would be down? if USD is down, EUR will be up trend,,, let's see.

Yesterday at 16:15 · Comment ·LikeUnlike · View feedback (3)Hide feedback (3)Chris Forex, -Falen Christianty- and Asmizal Ghazali like this..Write a comment....RECENT ACTIVITY

RemoveYu and Achmad Fadzil are now friends. · Comment ·LikeUnlike.Write a comment....

RemoveYu and Sergei Mochtchenkov are now friends. · Comment ·LikeUnlike.Write a comment....

RemoveYu and Rahma Johan are now friends. · Comment ·LikeUnlike.Write a comment....

RemoveYu Forex as I post 30 mins ago, I bought EURJPY 116.90, then now it is 117.42, that's right to buy on dip. :)

Yesterday at 15:39 · Comment ·LikeUnlikeWrite a comment....

RemoveYu Forex Greece worry → Germany would be great power in euro → German up, Euro Up → Euro money goes to US Bond → US Long Term interest down → mortgage down → U.S. market better → other market recover who knows? I just think money would goes like this.

Yesterday at 15:30 · Comment ·LikeUnlike · View feedback (5)Hide feedback (5)Chris Forex likes this..Forex Bookie Not sure I understand this but sounds good...:) Do you have those little"Bluff Your Way through.." booklets... ?

Yesterday at 15:33 · .Yu Forex thanks. I just guess market in several ways any time, lol. it is free to think anything. anyway, let's see how money goes.

Yesterday at 15:38 · .Ejaz Ahmad Ha ha ha great analysis Mr yu

Yesterday at 21:46 · .Yu Forex lol, anayze is just occult. :p but we can see Germany has great power more in euro.

13 hours ago · .Write a comment....RemoveYu Forex EUR is dropped, but market seems to agree with asist this time, Now EUR is dropping, but I buy now for short term. German will be great power in euro more. let's see euro index today, if it is still, I will just cut loss, that's it.

Yesterday at 15:12 · Comment ·LikeUnlike · View feedback (2)Hide feedback (2)Tradency Bvi and Chris Forex like this..Write a comment....RemoveYu Forex EUR is getting weak, I said if I were germany, I wanna get out EURO, but in real life German agree to support Greece, but why? there must be reason to make german have benefit, they are smart, if euro is getting weaker, german can export more and more, if german can be stronger in euro, totally it would be great benefi...t for them, I just can see like this... if they are so, they are smart.See more

Yesterday at 14:49 · Comment ·LikeUnlike · View feedback (1)Hide feedback (1)Raymond Kipngetich Fx likes this..

Yesterday at 17:46 · Comment ·UnlikeLike · View feedback (14)Hide feedback (14)You, 余潮泰, Anthony Lim and 2 others like this..余潮泰 This is wat we call pro!!!

Yesterday at 20:14 · .Komelisa Wardi 110 pips is really something. i'm interested to know what system are u using yu? f.a, technical..or both?thanks.

Yesterday at 20:35 · .Aaron Zutler Was a nice pivot point play. MACD divergence @ daily pivot point S1 .. Went straight up to PP @ 118.

Yesterday at 22:12 · .Yu Forex thank you, all. :) please see what I post before trading euro, we could see euro and england had index a lot today, and we could guess euro is good itself except pigs, and German will have great power in euro to asist greece this time. Today euro was down when I thought about long position at 116 level, market seems to agree this time asistance for...

See more

greece, but euro was too low, and we could see range was 116 to 118... I thought euro was too low, and it would make bottble bottom, and I checked eurojpy made bottom at 116.50, then it was up to 116.80 to 90, so I could see timing to buy the dip, and target was highest price at new york time yesterday, that's 118.50 line, but I am enough at 118.00, so my TC was 118.00. I trade with both fundamental and technical like this, and I see indicator, MACD, CCI, MA Indi, etc, but I never follow indicators like golden cross and etc, I just check how they go.

12 hours ago · .Vipul Met 1 Advice-Don't change, 1 request-take care, 1 wish-Don't forget me, 1 Lie-I hate U, 1 truth-I Miss U, 1 hope-We'll always be Gud Friend.....

3 hours ago · .Yu Forex ???

3 hours ago · .Vipul Met HA HA

2 hours ago · .Mohd Nizam hye buddy..may i ask what system you use to trade..

i am nubie...

about an hour ago · .Yu Forex please read what I wrote, also I understand my english is bad. I use both fundamental and techonical, indi is macd, stoch, MA, cci, etc, but I never fiollow indicator liike golden cross. I just try to buy on the dip. :)

8 minutes ago · .Mohd Nizam hehehe tq....are you full time trade bro?

4 minutes ago · .Write a comment....RemoveYu Forex what is meaning Gold is up, HF seems to buy, it means USD would be down? if USD is down, EUR will be up trend,,, let's see.

Yesterday at 16:15 · Comment ·LikeUnlike · View feedback (3)Hide feedback (3)Chris Forex, -Falen Christianty- and Asmizal Ghazali like this..Write a comment....RECENT ACTIVITY

RemoveYu and Achmad Fadzil are now friends. · Comment ·LikeUnlike.Write a comment....

RemoveYu and Sergei Mochtchenkov are now friends. · Comment ·LikeUnlike.Write a comment....

RemoveYu and Rahma Johan are now friends. · Comment ·LikeUnlike.Write a comment....

RemoveYu Forex as I post 30 mins ago, I bought EURJPY 116.90, then now it is 117.42, that's right to buy on dip. :)

Yesterday at 15:39 · Comment ·LikeUnlikeWrite a comment....

RemoveYu Forex Greece worry → Germany would be great power in euro → German up, Euro Up → Euro money goes to US Bond → US Long Term interest down → mortgage down → U.S. market better → other market recover who knows? I just think money would goes like this.

Yesterday at 15:30 · Comment ·LikeUnlike · View feedback (5)Hide feedback (5)Chris Forex likes this..Forex Bookie Not sure I understand this but sounds good...:) Do you have those little"Bluff Your Way through.." booklets... ?

Yesterday at 15:33 · .Yu Forex thanks. I just guess market in several ways any time, lol. it is free to think anything. anyway, let's see how money goes.

Yesterday at 15:38 · .Ejaz Ahmad Ha ha ha great analysis Mr yu

Yesterday at 21:46 · .Yu Forex lol, anayze is just occult. :p but we can see Germany has great power more in euro.

13 hours ago · .Write a comment....RemoveYu Forex EUR is dropped, but market seems to agree with asist this time, Now EUR is dropping, but I buy now for short term. German will be great power in euro more. let's see euro index today, if it is still, I will just cut loss, that's it.

Yesterday at 15:12 · Comment ·LikeUnlike · View feedback (2)Hide feedback (2)Tradency Bvi and Chris Forex like this..Write a comment....RemoveYu Forex EUR is getting weak, I said if I were germany, I wanna get out EURO, but in real life German agree to support Greece, but why? there must be reason to make german have benefit, they are smart, if euro is getting weaker, german can export more and more, if german can be stronger in euro, totally it would be great benefi...t for them, I just can see like this... if they are so, they are smart.See more

Yesterday at 14:49 · Comment ·LikeUnlike · View feedback (1)Hide feedback (1)Raymond Kipngetich Fx likes this..

Monday, May 10, 2010

Facebook on Forex

I use facebook for my trading view. Please check it out if you do not mind, http://www.facebook.com/yuy777?ref=profile

RemoveYu Forex http://www.forexfactory.com/news.php?do=news&id=235777

ok,,, it might be decision from learning after Lehman brothers shock. but where does this money come from??? EURO is miracle to exist itself, because working culture is different each ohter countres, some like German works and earns a lot, other like some country pr...efer works slowly and earn less, but it makes balance to be equal currency, that's euro, I still think it is miracle to exist, if i were German, I do think I try to get out euro. Anyway, it is not free to asist, money is paid, and where does/will this money come from? Now EUR is up today for short term. EURO worth will be less for a long term view.See more

EU Crafts $962 Billion Show of Force to Halt Crisis @ Forex Factory

www.forexfactory.com

European policy makers unveiled an unprecedented loan package worth nearly $1 trillion and a program of bond purchases as they spearheaded a global drive to stop a sovereign-debt crisis that...

about an hour ago · Comment ·LikeUnlike · View feedback (3)Hide feedback (3) · Share.Choppz Deathlotd, Carlos Fernando Cortes and 余潮泰 like this..Write a comment....

RemoveYu Forex news is old, important thing is to read next from news, not to watch and understand news, traders are not economist. Anyway I cannot see next, USDJPY is up, but I cannot read next anymore, so I rest and go to short trip, have a nice week. ;)

7 hours ago Only friends · Comment ·LikeUnlike · View feedback (4)Hide feedback (4)Carlos Fernando Cortes and Brian Carpenter like this..Brian Carpenter Ok, Yu. Enjoy.7 hours ago · .Yu Forex yeah, thank you. :) right now USDJPY tries to make full vol, that's like pattern 2 after 50% rule that I posted about on saturday, but I canot see next anymore, it means I better not trade :) 4 hours ago · .Write a comment....

RemoveYu Forex btw, on Friday morning, I bought Nikkei 10259 when it was down -400, and it was right to buy on the dip, now it is 10499 +134. Most of traders did not buy when I bought on friday, because news was only negative stuffs about Greece worry or DOW was down to less than 10000 on Thurs, to be continue

7 hours ago Only friends · Comment ·LikeUnlike · View feedback (4)Hide feedback (4)Michael Tdj and Beata Piktel like this..Beata Piktel great call - congrats7 hours ago · .Yu Forex thank you. :) yeah, I just called for 50% rule that I posted about on sat. it was 50% rules about Dow too after 2009. :) but I cannot see next after 50% rules, then It means I should not trade and go to trip with money I earn from thurs and fri last week. :) 4 hours ago · .Write a comment....

RemoveYu Forex 91.50 by 50% rules, there could be two patterns next, one is to up from 50% rules and then drop 100% more, it means at 84.50, lowest USDJPY last year... if USDJPY get down trend for long term. And second pattern is up to 50% more, making full vol. I cannot see anymore because I am lazy trader, let's go back to scalping. :)

Yesterday at 05:04 Only friends · Comment ·LikeUnlike · View feedback (3)Hide feedback (3)Solomon Akinode, 余潮泰 and Alhafiz Aay like this..Write a comment....

RemoveYu Forex greatest week on the market. :)

USDJPY is just simple, 50% rules again. 91.50 between 95 and 88. :)

so that was right to predict fixed on the middle, 91.50 level.

too much vol, then let's see simply.

have a nice weekend :)

Saturday at 05:18 Only friends · Comment ·LikeUnlike · View feedback (2)Hide feedback (2)Celine Klein and 余潮泰 like this..Write a comment....

RemoveYu Forex 1. today it is up from 88 to 93, 500 pips, middle is 90.50.

2. for three days it has been drop from 95 to 88, middle is 91.50.

to think about one and two, it can be range between 90.50 and 91.50?

now it has been droped, then if it is stop at 90.50, this theory probablry works. and pivot is also 91.145. it could be range. who knows? :)

Friday at 23:36 Only friends · Comment ·LikeUnlikeWrite a comment....

RemoveYu Forex that's why I bought Nikkei at the beginning of today no matter it is -400 down. let's see on Monaday. Good luck.

Friday at 23:26 Only friends · Comment ·LikeUnlikeWrite a comment....

RemoveYu Forex answer is NO. Worry is temparary issue. and if worry is big, it makes panic, and market moves because of panic, and its panic is made by worry, and worry is like temparary file in your computer, if files are full, you are gonna delete, market can be fix for overbought and overshort, and if it is temporary one, it can be fix soon.

Friday at 23:26 Only friends · Comment ·LikeUnlikeWrite a comment....

RemoveYu Forex Overbought and Overshort for currency, gold, oil, blah, blah, blah, news is still negative on TV and Radio, but do you think greek worry is such a big trigger to mess up market? worry is worry, people worry, but most of them forgot what they worried next year, do you remember what you worried last year? to be continue

Friday at 23:26 Only friends · Comment ·LikeUnlikeWrite a comment....

RemoveYu Forex and if it is down, it would be 90.35 (92.70 - 235pips) ? but it is too big to have vol. trading as USDJPY. Now stratedy is to stop long scalping during cloud and wait for index non farm rate and umemployment rate. then let's see what's going on, it is not late to trade after make sure trend from index

Friday at 14:49 Only friends · Comment ·LikeUnlike · View feedback (4)Hide feedback (4)Mike Hill and 余潮泰 like this..Mike Hill It was a shit storm here on the floor yesterday, just getting my ducks in a row for the unemployment numbers. Good luck today!Friday at 20:36 · .Yu Forex yeah, I watched CNBC at 3:45 am in tokyo yesterday. and I saw the moment Dow hit 10000, I heard some guy said it can be possible, lol, yes, he is right... btw, "million and billion" mistake can be cancel in United State!?

result is 209K but 9.9%, hahaha, USDJPY was drop 1 dolla 95 to 88 yen, middle is 91.50, it is too much vol as USDJPY, it is ... See moreextreme for USDJPY, it could be fixed around 91.50 level I guess, but I do not trade today, i will trade if trend is up on Monday, that's what I guess. let's see other fundamental news and stop loss orders might let price down as bear. :)

hank you for comment, you too, Good luck today!

Friday at 23:09 · .Write a comment....

RemoveYu Forex USDJPY 95.00 (wed) → 88.00 (vol. 700pips)(thursday) → +350pips (700/2) 91.5 (88.00 +350pips)(Friday), then I thought it would up 92.00 level, and actually it was up to 92.70 (+470pips), and now it is 92.00 level on the could of ichimoku. to be continue

Friday at 14:49 Only friends · Comment ·LikeUnlike · View feedback (2)Hide feedback (2)Kenzie Hiroki and Mike Hill like this..Write a comment....

RemoveYu Forex that's scary, I have been right all the way since I made short postion at 93.83 yesterday,,, 93.83 to 88.88 = 495 pips, 89.00 to 89.89 (99pips) I do not trade this one, then long to 92.00(I do not trade thsi one too), now is 92.50 level, if I trade all, it could be 800 pips,,, well, I can say anything if I think like t...hat. anyway important thing is to be carefull drawdown after big benefit.See more

Friday at 13:25 Only friends · Comment ·LikeUnlike · View feedback (1)Hide feedback (1)Mike Hill likes this..Write a comment....

RemoveYu Forex it hits 92.00! if i have long position 89.00, it is 200 pips more, then 700pips in 12hrs... that's why I realy think I am lazy trader, lol. anyway today's stratedy is scalping 7 to 10 pips with BB(bolinger band) wallk with long order.

Friday at 11:49 Only friends · Comment ·LikeUnlike · View feedback (4)Hide feedback (4)Josh Wilson and Evnt Trader like this..James Jay Harges good job yu!!Friday at 11:51 · .Yu Forex thanks , james :) Friday at 13:22 · .Write a comment....

RemoveYu Forex I slept 4hr, and I woke up 9 am in tokyo, USDJPY is 91.50! everything was right what I said five hr ago,,, but I did not have long postion at 89.00, and I slept! anyway it was big day yesterday. today's stratedy is to make long postion at scalping.

Friday at 09:56 Only friends · Comment ·LikeUnlike · View feedback (1)Hide feedback (1)Sayaka Takeda likes this..Write a comment....

RemoveYu Forex then, I was right, USDJPY hit 90.00, I could get total 600 pips if i make long like I said 45mins ago!!! >_< tomorrow if index will be good, it will be up to 92? who knows? I am just right all the way today.

Friday at 04:47 Only friends · Comment ·LikeUnlike · View feedback (6)Hide feedback (6)Anthony Lim and 余潮泰 like this...'Mk Chin Great! Take action... Friday at 13:13 · .Yu Forex thank you ~ :)Friday at 13:21 · .Write a comment....

RemoveYu Forex I should have long like I said ten mins ago. 89.00 long 89.99 TC, but whatever, enough to earn today!!! money games rule. good night. :)

Friday at 04:10 Only friends · Comment ·LikeUnlikeWrite a comment....

RemoveYu Forex great day for hedge fund :)

Friday at 04:07 Only friends · Comment ·LikeUnlikeWrite a comment....

RemoveYu Forex today is the day to start dropping to second bottom!?

Friday at 04:03 Only friends · Comment ·LikeUnlikeWrite a comment....

RemoveYu Forex Black Thursday 2!!! USDJPY hit my TC.88.88. I dropped 88.00!!! + 495pips, now I wonder to buy or not, but I better sleep with exciting,

Friday at 04:00 Only friends · Comment ·LikeUnlike · View feedback (1)Hide feedback (1)余潮泰 likes this..Write a comment....

RemoveYu Forex Black Thursday!!! USDJPY 93.83 short, 75pips trail. TC is 88.88. I do not think it will drop to 88, who knows? Conguratuate to short at pivot 94.60!!!

Friday at 03:33 Only friends · Comment ·LikeUnlikeWrite a comment....

RECENT ACTIVITY

Tuesday, March 2, 2010

Thursday, February 18, 2010

Tuesday, February 16, 2010

2.16

2Trade= 2 winner = JPY 344361yen 74.6pips

USDJPY Long 2.11 5 DaysEURUSD Short 2.15 1 Day

because I thought EUR is over short position, and USD is over long position, so I take profit my swing trading positions today.

because I thought EUR is over short position, and USD is over long position, so I take profit my swing trading positions today.

Wednesday, February 10, 2010

Friday, February 5, 2010

2.4

1 trade = 1 winner = +136pips 682500

nowadays it has not been good performance for scalping trade, then I change to swing trade from this month, I had short position for EUR JPY at 126.365 on Feb 2nd, because I considered resistance would be at 127.00 level, and then I made Stp at 127.50 and Lmt at 125.00. and it was right.

Saturday, January 30, 2010

Trade of this Month of January

Jan.11.2010 ~ Jan.29.2010

42 Trades = 19 Winners 24 Losers= +54.3 pips = JPY +336154

JPY ¥3361541JPY = 1JPY

USD $ 3724USD = 90.26JPY

EUR € 2686 1EUR =125.12EUR

42 Trades = 19 Winners 24 Losers= +54.3 pips = JPY +336154

JPY ¥3361541JPY = 1JPY

USD $ 3724USD = 90.26JPY

EUR € 2686 1EUR =125.12EUR

Jan 27 to Jan. 29

Jan 27 to Jan. 29

14Trades= 7 Winners 8 Losers= -42.2 pip. = JPY - 153180

JPY ¥-153180 1JPY = 1JPY

USD $--1697 1USD = 90.26JPY

EUR €-1224 1EUR =125.12EUR

14Trades= 7 Winners 8 Losers= -42.2 pip. = JPY - 153180

JPY ¥-153180 1JPY = 1JPY

USD $--1697 1USD = 90.26JPY

EUR €-1224 1EUR =125.12EUR

Friday, January 29, 2010

1.29

3 trades= 1 win 2 loser= -314000 -62.8 pips

if EUR JPY drop to 124.80, result was opposite, but reality is EURJPY dropped to 124.813, I just needed 1.3pips,,, but loss is loss, that's trade. it was right trend goes to 50pips to 75pips, today it just stopped at 73.7pips. but loss is loss.

if EUR JPY drop to 124.80, result was opposite, but reality is EURJPY dropped to 124.813, I just needed 1.3pips,,, but loss is loss, that's trade. it was right trend goes to 50pips to 75pips, today it just stopped at 73.7pips. but loss is loss.

Thursday, January 28, 2010

1.28

3 trades = 3 wins - 1 loses = +236000yen +47.2 pips

today I change trading method from scalping to day trade:

USD/JPY starts at 90.00 today, and and I ordered Long at 90.25 and Short at 89.75. because nowadays USD EUR follows trend after it achieves + or - 25 pips on its day, and today it achieves at 90.25, and I thougtht it would be 90.50, and I make TC at 90.50. and that's right trade, +25pips 125000yen.

EUR/JPY follows trend after it achieves + or - 50 pips, today it goes + 50 pips. for risk management to think about USDJPY position, I ordered both short and long positions at 126.20 to 22 level, and I make TC +75 pips LC -50pips for both position, and It was right trade, +353500 (+70.7pips) for long position and -249000(-49.8pips)

today I change trading method from scalping to day trade:

USD/JPY starts at 90.00 today, and and I ordered Long at 90.25 and Short at 89.75. because nowadays USD EUR follows trend after it achieves + or - 25 pips on its day, and today it achieves at 90.25, and I thougtht it would be 90.50, and I make TC at 90.50. and that's right trade, +25pips 125000yen.

EUR/JPY follows trend after it achieves + or - 50 pips, today it goes + 50 pips. for risk management to think about USDJPY position, I ordered both short and long positions at 126.20 to 22 level, and I make TC +75 pips LC -50pips for both position, and It was right trade, +353500 (+70.7pips) for long position and -249000(-49.8pips)

Black Monday vs. Bankruptcy of Lehman Brothers

http://en.wikipedia.org/wiki/Black_Monday_(1987)

http://en.wikipedia.org/wiki/Bankruptcy_of_Lehman_Brothers

History repeats itself. do not you think?

Black Monday 10.19.1987

Market expected "Japan" to raise the rate of interest,

and 19 months later, May 1989, first raise the rate of interest

Bankruptcy of Lehman Brothers 9.17.2008

now Market expects "China" to raise the rate of interest.

and if it will be 19 months later China would raise the rate of interest, it would be April 2010!?

http://en.wikipedia.org/wiki/Bankruptcy_of_Lehman_Brothers

History repeats itself. do not you think?

Black Monday 10.19.1987

Market expected "Japan" to raise the rate of interest,

and 19 months later, May 1989, first raise the rate of interest

Bankruptcy of Lehman Brothers 9.17.2008

now Market expects "China" to raise the rate of interest.

and if it will be 19 months later China would raise the rate of interest, it would be April 2010!?

Wednesday, January 27, 2010

Monday, January 25, 2010

trade of the week, Jan,19th to 22th

Jan 19 to Jan. 22

11Trades= 4 Winners 7 Losers= 43.9 pips = JPY+223750

JPY ¥+223750 1JPY = 1JPY

USD $+2491 1USD = 89.82JPY

EUR €+1762 1EUR =127.00EUR

Friday, January 22, 2010

1.22

4Trades = 2winners + 2losers = +46.2pips +231000

GBP JPY L +37.1pips +185500

USD JPY L +23.1pips +115500

AUD JPY L -6pips -30000

EUR JPY L -8pips -40000

it is not sure that cross JPY is range or down trend yet, so I had Long position for range option today, let's see next week.

Thursday, January 21, 2010

1.21

2 trades = 1 win - 1 loses = +117000 +23.4pips

AUD/JPY +160500 32.1pips

EUR/JPY -43500 -8.7pips

AUD/JPY 83.57 short entry 83.25 TC 83.75 LC →83.70→83.25 +32pips

EUR/JPY 129.03 Short entry 128.50 TC 129.30 LC →129.26→129.00→128.70→129.00→129.15 LC -8.7pips

AUD/JPY +160500 32.1pips

EUR/JPY -43500 -8.7pips

AUD/JPY 83.57 short entry 83.25 TC 83.75 LC →83.70→83.25 +32pips

EUR/JPY 129.03 Short entry 128.50 TC 129.30 LC →129.26→129.00→128.70→129.00→129.15 LC -8.7pips

Wednesday, January 20, 2010

28 currency pair Relative Strength tradeing method

this is better to see web site below than I write. :)

http://www.forexfactory.com/showthread.php?t=132537Tuesday, January 19, 2010

1.19

2 Trades = 2 losers = -18.5pips -88250 JPY

AUD/JPY S -9.5 pips

EUR/USD L -9pips

I make TC for EUR/USD at 1.4415, and max was 1.4413.

it is just a few pips again,.but that's trade to lose. No excuse.

Well done for risk management. that's only good thing today. :)

AUD/JPY S -9.5 pips

EUR/USD L -9pips

I make TC for EUR/USD at 1.4415, and max was 1.4413.

it is just a few pips again,.but that's trade to lose. No excuse.

Well done for risk management. that's only good thing today. :)

Monday, January 18, 2010

2010 schedule

2010 schedule: Trade is 4 days a week(Tue.to Fri), Off Day is 3 days a week(Sat to Mon)

Off days in 2010=196days: 3 Day times 52 weeks(365days/7days)=156 Off Days + 2 weeks holidays every 2 month (8days times 5 times holidays = 40 days) = 196 off days in 2010!

Trading days in 2010=170 days : 366-196days = 170days trade.

*it would be changed if it is better to trade on Monday.

Good luck on 2010

Off days in 2010=196days: 3 Day times 52 weeks(365days/7days)=156 Off Days + 2 weeks holidays every 2 month (8days times 5 times holidays = 40 days) = 196 off days in 2010!

Trading days in 2010=170 days : 366-196days = 170days trade.

*it would be changed if it is better to trade on Monday.

Good luck on 2010

Saturday, January 16, 2010

trade of this week Jan.11 to Jan.15

Jan 11 to Jan. 15

Jan. 15 3 Trades = 2wins +1 lose = 26.9 pips = JPY + 134500

Jan. 14 4 trades = 1 winners +3 losers = JPY -49116 -10.4pips

Jan. 13 4 Trades = 3 wins - 1 lose = JPY +152000 + 30.4 pips

Jan. 12 2 Trades = 2 Losers = JPY - 80000 -16pips

Jan. 11 4 Trades = 2 winners + 2 losers = JPY ¥ +108,200 21.7pips

17Trades= 8 Winners 9 Losers= 52.6 pips = JPY+265584

JPY ¥+265,584 1 JPY = 1JPY

USD $+2926 1 USD = 90.76:JPY

EUR €+2034 1 EUR =130.57:EUR

Jan. 15 3 Trades = 2wins +1 lose = 26.9 pips = JPY + 134500

Jan. 14 4 trades = 1 winners +3 losers = JPY -49116 -10.4pips

Jan. 13 4 Trades = 3 wins - 1 lose = JPY +152000 + 30.4 pips

Jan. 12 2 Trades = 2 Losers = JPY - 80000 -16pips

Jan. 11 4 Trades = 2 winners + 2 losers = JPY ¥ +108,200 21.7pips

Friday, January 15, 2010

1.15

3 Trades = 2wins +1 lose = 26.9 pips = JPY + 134500

USD/JPY S -17500

USD/JPY L 29000

USD/JPY L 123000

today's 15th, so please check past post ; http://yuforex777.blogspot.com/2010/01/trading-method-by-short-supply-of.html

According to this method,

at 8:00 to 10:00 am(JPN time) we buy USD/JPY.

at 10:00 am (JPN time) we sell USD/JPY.

today i slept until noon... -_-zzz

so I did not trade, but this trading method could be used today's too.

at 8:00 to 10:00 am, it was difficult to have long entry, so in this case let's see how to make loss cut to have minimum loss like less than 10 pips, then let's see next short position trade after 10:00 am, it was at 91.18 level for USD/JPY, no matter we make stop at 10 pips to 20 pips, USD/JPY dropped to 90.649 without loss cut, right? so it means we could get 50pips as well, if I were in the morning market today at Japan time, I make loss -10pis at 8:00 to 10:00 am, I make profit +15pips of 50 pips, then I could have + 5 pips profit. It is more important to have minimum loss than max profit in my theory, huge profit has always a critical draw down, we should not forget about it. Today we will have index just before NY market opens, Let's see USD would be down as the USDJPY analyze for short to middle term. :)

Have a good trade!

Thursday, January 14, 2010

Simple strategy 1 EMA × RSI × Stochastic

Indicator: 5 EMA, 10 EMA, Stochastic (14, 3, 3), RSI (14)

Strategy:

Entry:

1.Cross of 5EMA and 10EMA,

2.RSI is more than 50,

3.stochastic is not overshot (80~20) and cross.

TC or LC

Cross of 5EMA and 10EMA on the opposite side.

Strategy:

Entry:

1.Cross of 5EMA and 10EMA,

2.RSI is more than 50,

3.stochastic is not overshot (80~20) and cross.

TC or LC

Cross of 5EMA and 10EMA on the opposite side.

1.14

AUD/JPY -35000 -7pips

EUR/JPY -32000 -6.4pips

EUR/JPY -32116 -7pips

EUR/JPY 50000 +10pips

4 trades = 1 winners + 4 losers = JPY -49116 -10.4pips

EUR/JPY -32000 -6.4pips

EUR/JPY -32116 -7pips

EUR/JPY 50000 +10pips

4 trades = 1 winners + 4 losers = JPY -49116 -10.4pips

let me excuse please, First trade was so beautiful, long at 133.46 and TC at 133.56. and EUR JPY up from 133.46 to 133.56, then it dropped from 133.56,. so trend went as I expected, it was one of the most beautiful trades ever, but I thought I would lose today because I always lose after beautiful trade! >_< And I was right, I called it!!!

Anyway, This is a good example why we should not trade with our emotion, we should trade without emotion, this is total sum game. Today it was beautiful trade, the more beautiful trade is, the more I feel glad to have the beautiful trade mentally, it causes loss possibly.

Wednesday, January 13, 2010

USD/JPY analyze

we saw bad number of index on last Friday, non farm employment change and unemployment rate.

as I said on Facebook on last Friday, It is better to trade after we can see trend from index. and now we could see USD/JPY would be down. (sorry If I am wrong on analyze, but * please trade on your own responsibility, i wont's take any responsibility.)

First please see this pic below.

This is 300days daily candle chart.

now we could see down trend, and USD/JPY down to pass at 91.20..

91.20 is red support line on chart, and Hi-max is pink line at 93.70.

93.70 - 91.20 = 2.50

91.20 - 2.50 = 88.70

trend down to pass 91.20, and it down to 88.70 next on technical analyze.

if down trend will pass 88.70, next it would be 84.

Next, please see highest price at April 6 2009, Aug 7 2009, and Jan 8 2010, we can line for these three points as resistance line. Then we can consider USD/JPY was not convert yet and still continue down trend.

And According to Non Farm Employment Change and Unemployment Rate, we can see USD/JPY is down trend by fundamental analyze, Unemployment Rate has been 10% three months in raw,. and Non Farm Employment Change was minus again on Dec 2009.

I am not sure exactly how long down trend is continue, although I know people expect stronger USD, Market does not follow what people expect, I still see and consider that USD/PY is down trend.

.

as I said on Facebook on last Friday, It is better to trade after we can see trend from index. and now we could see USD/JPY would be down. (sorry If I am wrong on analyze, but * please trade on your own responsibility, i wont's take any responsibility.)

First please see this pic below.

This is 300days daily candle chart.

now we could see down trend, and USD/JPY down to pass at 91.20..

91.20 is red support line on chart, and Hi-max is pink line at 93.70.

93.70 - 91.20 = 2.50

91.20 - 2.50 = 88.70

trend down to pass 91.20, and it down to 88.70 next on technical analyze.

if down trend will pass 88.70, next it would be 84.

Next, please see highest price at April 6 2009, Aug 7 2009, and Jan 8 2010, we can line for these three points as resistance line. Then we can consider USD/JPY was not convert yet and still continue down trend.

And According to Non Farm Employment Change and Unemployment Rate, we can see USD/JPY is down trend by fundamental analyze, Unemployment Rate has been 10% three months in raw,. and Non Farm Employment Change was minus again on Dec 2009.

I am not sure exactly how long down trend is continue, although I know people expect stronger USD, Market does not follow what people expect, I still see and consider that USD/PY is down trend.

.

VQ parameter

VQ.mq4

VQ parameter from Scalping to Swing Trade.

4,2,4,1

2,0,4,1

2,3,3,3

5,3,2,5

5,3,6,2

6,3,3,2

6,3,4,2

7,3,2,2

3,2,3,4

4,0,2,4

7,3,4,6

7,3,2,2

3,2,3,4

4,0,2,4

7,3,4,6

5,3,1,2

5,3,1,2

5,3,1,3

5,3,1,3

8,2,22,2

10,3,18,25

30,1,30,1

VQ parameter from Scalping to Swing Trade.

4,2,4,1

2,0,4,1

2,3,3,3

5,3,2,5

5,3,6,2

6,3,3,2

6,3,4,2

7,3,2,2

3,2,3,4

4,0,2,4

7,3,4,6

7,3,2,2

3,2,3,4

4,0,2,4

7,3,4,6

5,3,1,2

5,3,1,2

5,3,1,3

5,3,1,3

8,2,22,2

10,3,18,25

30,1,30,1

EUR USD Analyze

If we analyze USD in this year, all of us care about FRB monetary policy, especially interest rate,.

and its interest rate affect other countries' currency, today I want to post about EUR/USD.

first, let's see about interest rate of ECB and FRB.

if we back to the past, as we know, ECB follows FRB to make interest rate no matter it is up or down. ECB decided interest rate after FRB, shortest period is 4 months, longest one is 18 months, and average is 9 months.

In Sep.1998: FRB Interest Rate: Down

7months later,

In Apr.1999: ECB Interest Rate: Down

Jun. 1999 FRB UP

5 months later

Nov.1999 ECB UP

01.2001 FRB DOWN

4 months later

05.2001 ECB DOWN

06.2004 FRB UP

18 months later

12.2005 ECB UP

9.2007 FRB DOWN

13 months later

10.2008 ECB DOWN

therefore, if FRB will make interest rate up on Aug 2010,. probably ECB will make interest rate up in Dec 2010 at shortest term estimation or after 2011 at long term estimation.

As noted above, ECB followed FRB, and EUR/USD tend to be strong USD and Weak EUR just before FRB makes interest rate up as data.

For Example,.last time FRB had made interest rate UP was Jun 2004 and Jun 1999. both time started strong USD and weak EUR from a few month ago around 10%. then trend had changed strong EUR and weak USD until ECB had made intrest rate at both time in 1999 and 2004.

If this time 2010 is also according to past data, EUR/USD would be 10 % drop, then EUR/USD 1.5 could be at 1.35. and strong USD starts half years before FRB makes higher interest rate.

Finally, if FRB will make higher interest rate on Aug 2010. USD would be getting stronger since March, but EUR/USD already dropped from 1.5 since end of last year, so FRB would make higher interest rate on May or Jun 2010, or FRB would make higher interest rate in Aug, and EUR USD drops since Mar 2010, nowadays EUR/USD has been up, right? so it could be Aug. then we can analyze;

Jan to Mar EUR/USD UP to 1.5

Apr to Sep EUR/USD Down to 1.35

Oct to Dec EUR/USD UP to ?

and its interest rate affect other countries' currency, today I want to post about EUR/USD.

first, let's see about interest rate of ECB and FRB.

if we back to the past, as we know, ECB follows FRB to make interest rate no matter it is up or down. ECB decided interest rate after FRB, shortest period is 4 months, longest one is 18 months, and average is 9 months.

In Sep.1998: FRB Interest Rate: Down

7months later,

In Apr.1999: ECB Interest Rate: Down

Jun. 1999 FRB UP

5 months later

Nov.1999 ECB UP

01.2001 FRB DOWN

4 months later

05.2001 ECB DOWN

06.2004 FRB UP

18 months later

12.2005 ECB UP

9.2007 FRB DOWN

13 months later

10.2008 ECB DOWN

therefore, if FRB will make interest rate up on Aug 2010,. probably ECB will make interest rate up in Dec 2010 at shortest term estimation or after 2011 at long term estimation.

As noted above, ECB followed FRB, and EUR/USD tend to be strong USD and Weak EUR just before FRB makes interest rate up as data.

For Example,.last time FRB had made interest rate UP was Jun 2004 and Jun 1999. both time started strong USD and weak EUR from a few month ago around 10%. then trend had changed strong EUR and weak USD until ECB had made intrest rate at both time in 1999 and 2004.

If this time 2010 is also according to past data, EUR/USD would be 10 % drop, then EUR/USD 1.5 could be at 1.35. and strong USD starts half years before FRB makes higher interest rate.

Finally, if FRB will make higher interest rate on Aug 2010. USD would be getting stronger since March, but EUR/USD already dropped from 1.5 since end of last year, so FRB would make higher interest rate on May or Jun 2010, or FRB would make higher interest rate in Aug, and EUR USD drops since Mar 2010, nowadays EUR/USD has been up, right? so it could be Aug. then we can analyze;

Jan to Mar EUR/USD UP to 1.5

Apr to Sep EUR/USD Down to 1.35

Oct to Dec EUR/USD UP to ?

1.13

4 Trades = 3 wins - 1 lose = JPY +152000 + 30.4 pips

EUR/JPY -50000 -10pips

EUR/JPY +61000 +12.5pips

USD/JPY +41000 +8.3pips

AUD/JPY +100000 +20pips

It was good trades except first one, I had long entry for AUD JPY at 84.14 on MA200 level, but it droped to 83.9... but I did not cut my loss, today I have good profit, but it is just result, I might have big loss today because of first one... :(

Selling timing

We often see advertise about ETF nowadays since end of year, right? It means People always buy the higest price anytime during ads season, Gold is always interesting to see, compared with USD and people, it looks recovering economic in this year, but inside traders' mind we are always ready to sell. A number of TV adv...ertise is quite correct indicator to sell. :)

When we see a lot of the same kind of advertisement broadcast or books published, it might be timing to sell,

When we see or hear neighborhood's house wives and college students start to invest stock, it might be timing to sell.

this is ironic, but it is true, market is expand when it is limited.

When we see a lot of the same kind of advertisement broadcast or books published, it might be timing to sell,

When we see or hear neighborhood's house wives and college students start to invest stock, it might be timing to sell.

this is ironic, but it is true, market is expand when it is limited.

about JAL

JAL is 37 yen,,, it is also great opportunity to trade stock almost broke down, but I could not. I wanted to be pilot when I was kid, so JAL is kinda special and symbol of my childfood dream,,, although traders should not have emotion and feeling neither, I do not want to see that my childfood hero is fail on my adlutf...ood no matter I do understand every bankrupt has reason and kids are innocent to love company without reason... It is hard to see that...

http://www.bloomberg.com/apps/news?pid=2

http://www.bloomberg.com/apps/news?pid=2

Tuesday, January 12, 2010

T3MA Trading Method

MT4: T3MA.mq4

T3MA

EMA 50 20 200

Long Entry:

1. entry when EMA 50 20 are above 5M T3MA

2. when EMA 50 or 20 are rally on resistance line

Short Entry

1.Entry when EMA 50 20 are below 5M T3MA

2. Entry when EMA 50 or 20 are rally on support line.

* when EMA200 comes. let's see what's going on.

* T3MA moves so strange, lt is better to ignore, and restart MT4, then check out

mild line position.

Jan.12.2010

2 Trades = 2 Losers

AUD/JPY -45000 -9pips

AUD/JPY -35000 -7pips

JPY - 80000 -16pips

I feel I am loser if I do not excuse today's loss from now on, LOL

First Trade is not wrong entry, here it was 15:00, and Euro was getting start market,.

so I expected price would be up, and I was right AUD/JPY rose up,. I expect 15 pips at least, but it rose just 12 pips, and benefit was gone, and I have to get loss.

Second Trade is nothing to say.

No matter I lost today, I did well for risk management. That's more important to manage risk. :)

Good luck for your trade :)

Monday, January 11, 2010

First Trade on 2010

Today is the first day to trade. :)

4 Trades = 2 winners + 2 losers

AUD/JPY Long 17.9 pips JPY +89500

USD/JPY L 7.9 pips JPY -39800

USD/JPY L 7pips JPY -35000

USD/JPY L 18.7pips JPY +93500

Total JPY ¥ +108,200 21.7pips

Japan is holiday(Coming-of-Age Day) today. so I did not trade during Tokyo market time, I started after Tokyo close to London market open. As I expected, price rate has been up since Euro market opened. I thought open time is easiest to earn today, and I was right. Although I should stop trade today after I finished 3rd trade (-7.9pips), AUD/JPY looked like jumping up. I had Long position for AUD/JPY at 85.92. that's right trade, it rose up to 86.10 as I expected, then I got 17.9 pips. It is good start trading in 2010. Good luck for trading, you guys too. :)

How to see entry point for day trade

MT4:

ADXm.mq4

00-MTFizer_v102.mq4

Candle 30 mins Candle Chart for 00-MTFizer

TimeFrame -1 and -2

ADXm is for trend follow

we could see hint of entry point for Day Trade to use this method.

Friday, January 8, 2010

ADX and Parablic trend follow trading method

MT4:

Parabolic SAR default settings (0.02, 0.2)

ADX 50 (with +DI, -DI lines)

Strategy:

ADX set parameter to 50

Entry "Parabolic trend follow" and "+DI and -DI cross".

Ignore "+DI and -DI cross" and "Parabolic rally"

TC "+DI and -DI opposite side Cross" or "ADX would achieve 25 line"

Parabolic SAR default settings (0.02, 0.2)

ADX 50 (with +DI, -DI lines)

Strategy:

ADX set parameter to 50

Entry "Parabolic trend follow" and "+DI and -DI cross".

Ignore "+DI and -DI cross" and "Parabolic rally"

TC "+DI and -DI opposite side Cross" or "ADX would achieve 25 line"

Wednesday, January 6, 2010

EUR/USD 30min Trading method with MACD + Parabolic

MT4 Indicator

MACD (12, 26, 9)

Parabolic SAR default settings (0.02, 0.2)

Strategy:

Entry

1. MACD Cross

2 Parabolic trend follow

TC

1.MACD Cross

* I have posted several methods. I feel sorry I cannot show more detail, btw, some people asked me question on these days like this "those methods can be used currently or not?" answer is Yes and No, because those methods were used before, and I just post each one method of over 200 hundreds methods per day, it can be used right now but also cannot be used right now, we do not know what future trend will be like exactly. If you like some of methods and would like to use it, PLEASE DO BACK TEST FIRST, there is no trade we can use forever because market trend has changed each term. When i use new trading method on the market, first I do back test and demo, then if I get good result from back test and demo, I start to use new trading method on the market until it is expired. *** Please trade your own risk and responsibility, I won't take any responsibility for you trade and result of win and lose. Good luck for trade! :)

Tuesday, January 5, 2010

00-RVI_v100.mq4 00-SuccessTrade.mq4

MT4 :

00-RVI_v100.mq4

00-SuccessTrade.mq4

It is interesting MT4 system trading method, but we have to check it can be used for current trend on the market or not. If it is ready, then it would works :)

result on Jan. 4th with TTM in short supply trading method

please compared with yesterday blog about TTM trading method.

today's 5th Jan. Let's see how it is going.

8:00 a.m. Japan time:

start price on USD/JPY was 92.416

and let's see "strategy" on yesterday blog,

we order long position to aim 10 to 30 pips afer 8:00.

USD JPY was 92.416 at 8:00 am

and USD JPY rose up to 92.538 at 8:22 am

then we could have 10 pips

next. let's see USD JPY at 10:00 am

according to stratedy, we order short position to aim 10 to 30 pips after 10:00 am.

start price of USD JPY was 92.362 at 10:00 am

then, USD JPY has dropped to 91.62 at present,

we could get 10 pips, moreover 30 pips as well. :)

I do think 10 pips is enough, we could get 30 pips and 70 pips right now.

that's one of trading methods on 5th. 10th, 15th, 20th, 25th each month :)

today's 5th Jan. Let's see how it is going.

8:00 a.m. Japan time:

start price on USD/JPY was 92.416

and let's see "strategy" on yesterday blog,

we order long position to aim 10 to 30 pips afer 8:00.

USD JPY was 92.416 at 8:00 am

and USD JPY rose up to 92.538 at 8:22 am

then we could have 10 pips

next. let's see USD JPY at 10:00 am

according to stratedy, we order short position to aim 10 to 30 pips after 10:00 am.

start price of USD JPY was 92.362 at 10:00 am

then, USD JPY has dropped to 91.62 at present,

we could get 10 pips, moreover 30 pips as well. :)

I do think 10 pips is enough, we could get 30 pips and 70 pips right now.

that's one of trading methods on 5th. 10th, 15th, 20th, 25th each month :)

Subscribe to:

Posts (Atom)