Jan.11.2010 ~ Jan.29.2010

42 Trades = 19 Winners 24 Losers= +54.3 pips = JPY +336154

JPY ¥3361541JPY = 1JPY

USD $ 3724USD = 90.26JPY

EUR € 2686 1EUR =125.12EUR

Saturday, January 30, 2010

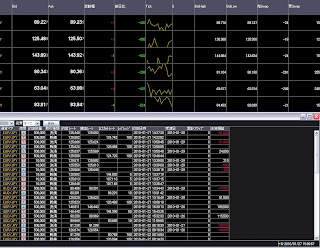

Jan 27 to Jan. 29

Jan 27 to Jan. 29

14Trades= 7 Winners 8 Losers= -42.2 pip. = JPY - 153180

JPY ¥-153180 1JPY = 1JPY

USD $--1697 1USD = 90.26JPY

EUR €-1224 1EUR =125.12EUR

14Trades= 7 Winners 8 Losers= -42.2 pip. = JPY - 153180

JPY ¥-153180 1JPY = 1JPY

USD $--1697 1USD = 90.26JPY

EUR €-1224 1EUR =125.12EUR

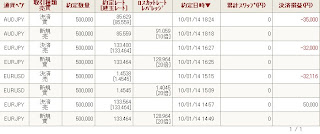

Friday, January 29, 2010

1.29

3 trades= 1 win 2 loser= -314000 -62.8 pips

if EUR JPY drop to 124.80, result was opposite, but reality is EURJPY dropped to 124.813, I just needed 1.3pips,,, but loss is loss, that's trade. it was right trend goes to 50pips to 75pips, today it just stopped at 73.7pips. but loss is loss.

if EUR JPY drop to 124.80, result was opposite, but reality is EURJPY dropped to 124.813, I just needed 1.3pips,,, but loss is loss, that's trade. it was right trend goes to 50pips to 75pips, today it just stopped at 73.7pips. but loss is loss.

Thursday, January 28, 2010

1.28

3 trades = 3 wins - 1 loses = +236000yen +47.2 pips

today I change trading method from scalping to day trade:

USD/JPY starts at 90.00 today, and and I ordered Long at 90.25 and Short at 89.75. because nowadays USD EUR follows trend after it achieves + or - 25 pips on its day, and today it achieves at 90.25, and I thougtht it would be 90.50, and I make TC at 90.50. and that's right trade, +25pips 125000yen.

EUR/JPY follows trend after it achieves + or - 50 pips, today it goes + 50 pips. for risk management to think about USDJPY position, I ordered both short and long positions at 126.20 to 22 level, and I make TC +75 pips LC -50pips for both position, and It was right trade, +353500 (+70.7pips) for long position and -249000(-49.8pips)

today I change trading method from scalping to day trade:

USD/JPY starts at 90.00 today, and and I ordered Long at 90.25 and Short at 89.75. because nowadays USD EUR follows trend after it achieves + or - 25 pips on its day, and today it achieves at 90.25, and I thougtht it would be 90.50, and I make TC at 90.50. and that's right trade, +25pips 125000yen.

EUR/JPY follows trend after it achieves + or - 50 pips, today it goes + 50 pips. for risk management to think about USDJPY position, I ordered both short and long positions at 126.20 to 22 level, and I make TC +75 pips LC -50pips for both position, and It was right trade, +353500 (+70.7pips) for long position and -249000(-49.8pips)

Black Monday vs. Bankruptcy of Lehman Brothers

http://en.wikipedia.org/wiki/Black_Monday_(1987)

http://en.wikipedia.org/wiki/Bankruptcy_of_Lehman_Brothers

History repeats itself. do not you think?

Black Monday 10.19.1987

Market expected "Japan" to raise the rate of interest,

and 19 months later, May 1989, first raise the rate of interest

Bankruptcy of Lehman Brothers 9.17.2008

now Market expects "China" to raise the rate of interest.

and if it will be 19 months later China would raise the rate of interest, it would be April 2010!?

http://en.wikipedia.org/wiki/Bankruptcy_of_Lehman_Brothers

History repeats itself. do not you think?

Black Monday 10.19.1987

Market expected "Japan" to raise the rate of interest,

and 19 months later, May 1989, first raise the rate of interest

Bankruptcy of Lehman Brothers 9.17.2008

now Market expects "China" to raise the rate of interest.

and if it will be 19 months later China would raise the rate of interest, it would be April 2010!?

Wednesday, January 27, 2010

Monday, January 25, 2010

trade of the week, Jan,19th to 22th

Jan 19 to Jan. 22

11Trades= 4 Winners 7 Losers= 43.9 pips = JPY+223750

JPY ¥+223750 1JPY = 1JPY

USD $+2491 1USD = 89.82JPY

EUR €+1762 1EUR =127.00EUR

Friday, January 22, 2010

1.22

4Trades = 2winners + 2losers = +46.2pips +231000

GBP JPY L +37.1pips +185500

USD JPY L +23.1pips +115500

AUD JPY L -6pips -30000

EUR JPY L -8pips -40000

it is not sure that cross JPY is range or down trend yet, so I had Long position for range option today, let's see next week.

Thursday, January 21, 2010

1.21

2 trades = 1 win - 1 loses = +117000 +23.4pips

AUD/JPY +160500 32.1pips

EUR/JPY -43500 -8.7pips

AUD/JPY 83.57 short entry 83.25 TC 83.75 LC →83.70→83.25 +32pips

EUR/JPY 129.03 Short entry 128.50 TC 129.30 LC →129.26→129.00→128.70→129.00→129.15 LC -8.7pips

AUD/JPY +160500 32.1pips

EUR/JPY -43500 -8.7pips

AUD/JPY 83.57 short entry 83.25 TC 83.75 LC →83.70→83.25 +32pips

EUR/JPY 129.03 Short entry 128.50 TC 129.30 LC →129.26→129.00→128.70→129.00→129.15 LC -8.7pips

Wednesday, January 20, 2010

28 currency pair Relative Strength tradeing method

this is better to see web site below than I write. :)

http://www.forexfactory.com/showthread.php?t=132537Tuesday, January 19, 2010

1.19

2 Trades = 2 losers = -18.5pips -88250 JPY

AUD/JPY S -9.5 pips

EUR/USD L -9pips

I make TC for EUR/USD at 1.4415, and max was 1.4413.

it is just a few pips again,.but that's trade to lose. No excuse.

Well done for risk management. that's only good thing today. :)

AUD/JPY S -9.5 pips

EUR/USD L -9pips

I make TC for EUR/USD at 1.4415, and max was 1.4413.

it is just a few pips again,.but that's trade to lose. No excuse.

Well done for risk management. that's only good thing today. :)

Monday, January 18, 2010

2010 schedule

2010 schedule: Trade is 4 days a week(Tue.to Fri), Off Day is 3 days a week(Sat to Mon)

Off days in 2010=196days: 3 Day times 52 weeks(365days/7days)=156 Off Days + 2 weeks holidays every 2 month (8days times 5 times holidays = 40 days) = 196 off days in 2010!

Trading days in 2010=170 days : 366-196days = 170days trade.

*it would be changed if it is better to trade on Monday.

Good luck on 2010

Off days in 2010=196days: 3 Day times 52 weeks(365days/7days)=156 Off Days + 2 weeks holidays every 2 month (8days times 5 times holidays = 40 days) = 196 off days in 2010!

Trading days in 2010=170 days : 366-196days = 170days trade.

*it would be changed if it is better to trade on Monday.

Good luck on 2010

Saturday, January 16, 2010

trade of this week Jan.11 to Jan.15

Jan 11 to Jan. 15

Jan. 15 3 Trades = 2wins +1 lose = 26.9 pips = JPY + 134500

Jan. 14 4 trades = 1 winners +3 losers = JPY -49116 -10.4pips

Jan. 13 4 Trades = 3 wins - 1 lose = JPY +152000 + 30.4 pips

Jan. 12 2 Trades = 2 Losers = JPY - 80000 -16pips

Jan. 11 4 Trades = 2 winners + 2 losers = JPY ¥ +108,200 21.7pips

17Trades= 8 Winners 9 Losers= 52.6 pips = JPY+265584

JPY ¥+265,584 1 JPY = 1JPY

USD $+2926 1 USD = 90.76:JPY

EUR €+2034 1 EUR =130.57:EUR

Jan. 15 3 Trades = 2wins +1 lose = 26.9 pips = JPY + 134500

Jan. 14 4 trades = 1 winners +3 losers = JPY -49116 -10.4pips

Jan. 13 4 Trades = 3 wins - 1 lose = JPY +152000 + 30.4 pips

Jan. 12 2 Trades = 2 Losers = JPY - 80000 -16pips

Jan. 11 4 Trades = 2 winners + 2 losers = JPY ¥ +108,200 21.7pips

Friday, January 15, 2010

1.15

3 Trades = 2wins +1 lose = 26.9 pips = JPY + 134500

USD/JPY S -17500

USD/JPY L 29000

USD/JPY L 123000

today's 15th, so please check past post ; http://yuforex777.blogspot.com/2010/01/trading-method-by-short-supply-of.html

According to this method,

at 8:00 to 10:00 am(JPN time) we buy USD/JPY.

at 10:00 am (JPN time) we sell USD/JPY.

today i slept until noon... -_-zzz

so I did not trade, but this trading method could be used today's too.

at 8:00 to 10:00 am, it was difficult to have long entry, so in this case let's see how to make loss cut to have minimum loss like less than 10 pips, then let's see next short position trade after 10:00 am, it was at 91.18 level for USD/JPY, no matter we make stop at 10 pips to 20 pips, USD/JPY dropped to 90.649 without loss cut, right? so it means we could get 50pips as well, if I were in the morning market today at Japan time, I make loss -10pis at 8:00 to 10:00 am, I make profit +15pips of 50 pips, then I could have + 5 pips profit. It is more important to have minimum loss than max profit in my theory, huge profit has always a critical draw down, we should not forget about it. Today we will have index just before NY market opens, Let's see USD would be down as the USDJPY analyze for short to middle term. :)

Have a good trade!

Thursday, January 14, 2010

Simple strategy 1 EMA × RSI × Stochastic

Indicator: 5 EMA, 10 EMA, Stochastic (14, 3, 3), RSI (14)

Strategy:

Entry:

1.Cross of 5EMA and 10EMA,

2.RSI is more than 50,

3.stochastic is not overshot (80~20) and cross.

TC or LC

Cross of 5EMA and 10EMA on the opposite side.

Strategy:

Entry:

1.Cross of 5EMA and 10EMA,

2.RSI is more than 50,

3.stochastic is not overshot (80~20) and cross.

TC or LC

Cross of 5EMA and 10EMA on the opposite side.

1.14

AUD/JPY -35000 -7pips

EUR/JPY -32000 -6.4pips

EUR/JPY -32116 -7pips

EUR/JPY 50000 +10pips

4 trades = 1 winners + 4 losers = JPY -49116 -10.4pips

EUR/JPY -32000 -6.4pips

EUR/JPY -32116 -7pips

EUR/JPY 50000 +10pips

4 trades = 1 winners + 4 losers = JPY -49116 -10.4pips

let me excuse please, First trade was so beautiful, long at 133.46 and TC at 133.56. and EUR JPY up from 133.46 to 133.56, then it dropped from 133.56,. so trend went as I expected, it was one of the most beautiful trades ever, but I thought I would lose today because I always lose after beautiful trade! >_< And I was right, I called it!!!

Anyway, This is a good example why we should not trade with our emotion, we should trade without emotion, this is total sum game. Today it was beautiful trade, the more beautiful trade is, the more I feel glad to have the beautiful trade mentally, it causes loss possibly.

Wednesday, January 13, 2010

USD/JPY analyze

we saw bad number of index on last Friday, non farm employment change and unemployment rate.

as I said on Facebook on last Friday, It is better to trade after we can see trend from index. and now we could see USD/JPY would be down. (sorry If I am wrong on analyze, but * please trade on your own responsibility, i wont's take any responsibility.)

First please see this pic below.

This is 300days daily candle chart.

now we could see down trend, and USD/JPY down to pass at 91.20..

91.20 is red support line on chart, and Hi-max is pink line at 93.70.

93.70 - 91.20 = 2.50

91.20 - 2.50 = 88.70

trend down to pass 91.20, and it down to 88.70 next on technical analyze.

if down trend will pass 88.70, next it would be 84.

Next, please see highest price at April 6 2009, Aug 7 2009, and Jan 8 2010, we can line for these three points as resistance line. Then we can consider USD/JPY was not convert yet and still continue down trend.

And According to Non Farm Employment Change and Unemployment Rate, we can see USD/JPY is down trend by fundamental analyze, Unemployment Rate has been 10% three months in raw,. and Non Farm Employment Change was minus again on Dec 2009.

I am not sure exactly how long down trend is continue, although I know people expect stronger USD, Market does not follow what people expect, I still see and consider that USD/PY is down trend.

.

as I said on Facebook on last Friday, It is better to trade after we can see trend from index. and now we could see USD/JPY would be down. (sorry If I am wrong on analyze, but * please trade on your own responsibility, i wont's take any responsibility.)

First please see this pic below.

This is 300days daily candle chart.

now we could see down trend, and USD/JPY down to pass at 91.20..

91.20 is red support line on chart, and Hi-max is pink line at 93.70.

93.70 - 91.20 = 2.50

91.20 - 2.50 = 88.70

trend down to pass 91.20, and it down to 88.70 next on technical analyze.

if down trend will pass 88.70, next it would be 84.

Next, please see highest price at April 6 2009, Aug 7 2009, and Jan 8 2010, we can line for these three points as resistance line. Then we can consider USD/JPY was not convert yet and still continue down trend.

And According to Non Farm Employment Change and Unemployment Rate, we can see USD/JPY is down trend by fundamental analyze, Unemployment Rate has been 10% three months in raw,. and Non Farm Employment Change was minus again on Dec 2009.

I am not sure exactly how long down trend is continue, although I know people expect stronger USD, Market does not follow what people expect, I still see and consider that USD/PY is down trend.

.

VQ parameter

VQ.mq4

VQ parameter from Scalping to Swing Trade.

4,2,4,1

2,0,4,1

2,3,3,3

5,3,2,5

5,3,6,2

6,3,3,2

6,3,4,2

7,3,2,2

3,2,3,4

4,0,2,4

7,3,4,6

7,3,2,2

3,2,3,4

4,0,2,4

7,3,4,6

5,3,1,2

5,3,1,2

5,3,1,3

5,3,1,3

8,2,22,2

10,3,18,25

30,1,30,1

VQ parameter from Scalping to Swing Trade.

4,2,4,1

2,0,4,1

2,3,3,3

5,3,2,5

5,3,6,2

6,3,3,2

6,3,4,2

7,3,2,2

3,2,3,4

4,0,2,4

7,3,4,6

7,3,2,2

3,2,3,4

4,0,2,4

7,3,4,6

5,3,1,2

5,3,1,2

5,3,1,3

5,3,1,3

8,2,22,2

10,3,18,25

30,1,30,1

EUR USD Analyze

If we analyze USD in this year, all of us care about FRB monetary policy, especially interest rate,.

and its interest rate affect other countries' currency, today I want to post about EUR/USD.

first, let's see about interest rate of ECB and FRB.

if we back to the past, as we know, ECB follows FRB to make interest rate no matter it is up or down. ECB decided interest rate after FRB, shortest period is 4 months, longest one is 18 months, and average is 9 months.

In Sep.1998: FRB Interest Rate: Down

7months later,

In Apr.1999: ECB Interest Rate: Down

Jun. 1999 FRB UP

5 months later

Nov.1999 ECB UP

01.2001 FRB DOWN

4 months later

05.2001 ECB DOWN

06.2004 FRB UP

18 months later

12.2005 ECB UP

9.2007 FRB DOWN

13 months later

10.2008 ECB DOWN

therefore, if FRB will make interest rate up on Aug 2010,. probably ECB will make interest rate up in Dec 2010 at shortest term estimation or after 2011 at long term estimation.

As noted above, ECB followed FRB, and EUR/USD tend to be strong USD and Weak EUR just before FRB makes interest rate up as data.

For Example,.last time FRB had made interest rate UP was Jun 2004 and Jun 1999. both time started strong USD and weak EUR from a few month ago around 10%. then trend had changed strong EUR and weak USD until ECB had made intrest rate at both time in 1999 and 2004.

If this time 2010 is also according to past data, EUR/USD would be 10 % drop, then EUR/USD 1.5 could be at 1.35. and strong USD starts half years before FRB makes higher interest rate.

Finally, if FRB will make higher interest rate on Aug 2010. USD would be getting stronger since March, but EUR/USD already dropped from 1.5 since end of last year, so FRB would make higher interest rate on May or Jun 2010, or FRB would make higher interest rate in Aug, and EUR USD drops since Mar 2010, nowadays EUR/USD has been up, right? so it could be Aug. then we can analyze;

Jan to Mar EUR/USD UP to 1.5

Apr to Sep EUR/USD Down to 1.35

Oct to Dec EUR/USD UP to ?

and its interest rate affect other countries' currency, today I want to post about EUR/USD.

first, let's see about interest rate of ECB and FRB.

if we back to the past, as we know, ECB follows FRB to make interest rate no matter it is up or down. ECB decided interest rate after FRB, shortest period is 4 months, longest one is 18 months, and average is 9 months.

In Sep.1998: FRB Interest Rate: Down

7months later,

In Apr.1999: ECB Interest Rate: Down

Jun. 1999 FRB UP

5 months later

Nov.1999 ECB UP

01.2001 FRB DOWN

4 months later

05.2001 ECB DOWN

06.2004 FRB UP

18 months later

12.2005 ECB UP

9.2007 FRB DOWN

13 months later

10.2008 ECB DOWN

therefore, if FRB will make interest rate up on Aug 2010,. probably ECB will make interest rate up in Dec 2010 at shortest term estimation or after 2011 at long term estimation.

As noted above, ECB followed FRB, and EUR/USD tend to be strong USD and Weak EUR just before FRB makes interest rate up as data.

For Example,.last time FRB had made interest rate UP was Jun 2004 and Jun 1999. both time started strong USD and weak EUR from a few month ago around 10%. then trend had changed strong EUR and weak USD until ECB had made intrest rate at both time in 1999 and 2004.

If this time 2010 is also according to past data, EUR/USD would be 10 % drop, then EUR/USD 1.5 could be at 1.35. and strong USD starts half years before FRB makes higher interest rate.

Finally, if FRB will make higher interest rate on Aug 2010. USD would be getting stronger since March, but EUR/USD already dropped from 1.5 since end of last year, so FRB would make higher interest rate on May or Jun 2010, or FRB would make higher interest rate in Aug, and EUR USD drops since Mar 2010, nowadays EUR/USD has been up, right? so it could be Aug. then we can analyze;

Jan to Mar EUR/USD UP to 1.5

Apr to Sep EUR/USD Down to 1.35

Oct to Dec EUR/USD UP to ?

1.13

4 Trades = 3 wins - 1 lose = JPY +152000 + 30.4 pips

EUR/JPY -50000 -10pips

EUR/JPY +61000 +12.5pips

USD/JPY +41000 +8.3pips

AUD/JPY +100000 +20pips

It was good trades except first one, I had long entry for AUD JPY at 84.14 on MA200 level, but it droped to 83.9... but I did not cut my loss, today I have good profit, but it is just result, I might have big loss today because of first one... :(

Selling timing

We often see advertise about ETF nowadays since end of year, right? It means People always buy the higest price anytime during ads season, Gold is always interesting to see, compared with USD and people, it looks recovering economic in this year, but inside traders' mind we are always ready to sell. A number of TV adv...ertise is quite correct indicator to sell. :)

When we see a lot of the same kind of advertisement broadcast or books published, it might be timing to sell,

When we see or hear neighborhood's house wives and college students start to invest stock, it might be timing to sell.

this is ironic, but it is true, market is expand when it is limited.

When we see a lot of the same kind of advertisement broadcast or books published, it might be timing to sell,

When we see or hear neighborhood's house wives and college students start to invest stock, it might be timing to sell.

this is ironic, but it is true, market is expand when it is limited.

about JAL

JAL is 37 yen,,, it is also great opportunity to trade stock almost broke down, but I could not. I wanted to be pilot when I was kid, so JAL is kinda special and symbol of my childfood dream,,, although traders should not have emotion and feeling neither, I do not want to see that my childfood hero is fail on my adlutf...ood no matter I do understand every bankrupt has reason and kids are innocent to love company without reason... It is hard to see that...

http://www.bloomberg.com/apps/news?pid=2

http://www.bloomberg.com/apps/news?pid=2

Tuesday, January 12, 2010

T3MA Trading Method

MT4: T3MA.mq4

T3MA

EMA 50 20 200

Long Entry:

1. entry when EMA 50 20 are above 5M T3MA

2. when EMA 50 or 20 are rally on resistance line

Short Entry

1.Entry when EMA 50 20 are below 5M T3MA

2. Entry when EMA 50 or 20 are rally on support line.

* when EMA200 comes. let's see what's going on.

* T3MA moves so strange, lt is better to ignore, and restart MT4, then check out

mild line position.

Jan.12.2010

2 Trades = 2 Losers

AUD/JPY -45000 -9pips

AUD/JPY -35000 -7pips

JPY - 80000 -16pips

I feel I am loser if I do not excuse today's loss from now on, LOL

First Trade is not wrong entry, here it was 15:00, and Euro was getting start market,.

so I expected price would be up, and I was right AUD/JPY rose up,. I expect 15 pips at least, but it rose just 12 pips, and benefit was gone, and I have to get loss.

Second Trade is nothing to say.

No matter I lost today, I did well for risk management. That's more important to manage risk. :)

Good luck for your trade :)

Monday, January 11, 2010

First Trade on 2010

Today is the first day to trade. :)

4 Trades = 2 winners + 2 losers

AUD/JPY Long 17.9 pips JPY +89500

USD/JPY L 7.9 pips JPY -39800

USD/JPY L 7pips JPY -35000

USD/JPY L 18.7pips JPY +93500

Total JPY ¥ +108,200 21.7pips

Japan is holiday(Coming-of-Age Day) today. so I did not trade during Tokyo market time, I started after Tokyo close to London market open. As I expected, price rate has been up since Euro market opened. I thought open time is easiest to earn today, and I was right. Although I should stop trade today after I finished 3rd trade (-7.9pips), AUD/JPY looked like jumping up. I had Long position for AUD/JPY at 85.92. that's right trade, it rose up to 86.10 as I expected, then I got 17.9 pips. It is good start trading in 2010. Good luck for trading, you guys too. :)

How to see entry point for day trade

MT4:

ADXm.mq4

00-MTFizer_v102.mq4

Candle 30 mins Candle Chart for 00-MTFizer

TimeFrame -1 and -2

ADXm is for trend follow

we could see hint of entry point for Day Trade to use this method.

Friday, January 8, 2010

ADX and Parablic trend follow trading method

MT4:

Parabolic SAR default settings (0.02, 0.2)

ADX 50 (with +DI, -DI lines)

Strategy:

ADX set parameter to 50

Entry "Parabolic trend follow" and "+DI and -DI cross".

Ignore "+DI and -DI cross" and "Parabolic rally"

TC "+DI and -DI opposite side Cross" or "ADX would achieve 25 line"

Parabolic SAR default settings (0.02, 0.2)

ADX 50 (with +DI, -DI lines)

Strategy:

ADX set parameter to 50

Entry "Parabolic trend follow" and "+DI and -DI cross".

Ignore "+DI and -DI cross" and "Parabolic rally"

TC "+DI and -DI opposite side Cross" or "ADX would achieve 25 line"

Wednesday, January 6, 2010

EUR/USD 30min Trading method with MACD + Parabolic

MT4 Indicator

MACD (12, 26, 9)

Parabolic SAR default settings (0.02, 0.2)

Strategy:

Entry

1. MACD Cross

2 Parabolic trend follow

TC

1.MACD Cross

* I have posted several methods. I feel sorry I cannot show more detail, btw, some people asked me question on these days like this "those methods can be used currently or not?" answer is Yes and No, because those methods were used before, and I just post each one method of over 200 hundreds methods per day, it can be used right now but also cannot be used right now, we do not know what future trend will be like exactly. If you like some of methods and would like to use it, PLEASE DO BACK TEST FIRST, there is no trade we can use forever because market trend has changed each term. When i use new trading method on the market, first I do back test and demo, then if I get good result from back test and demo, I start to use new trading method on the market until it is expired. *** Please trade your own risk and responsibility, I won't take any responsibility for you trade and result of win and lose. Good luck for trade! :)

Tuesday, January 5, 2010

00-RVI_v100.mq4 00-SuccessTrade.mq4

MT4 :

00-RVI_v100.mq4

00-SuccessTrade.mq4

It is interesting MT4 system trading method, but we have to check it can be used for current trend on the market or not. If it is ready, then it would works :)

result on Jan. 4th with TTM in short supply trading method

please compared with yesterday blog about TTM trading method.

today's 5th Jan. Let's see how it is going.

8:00 a.m. Japan time:

start price on USD/JPY was 92.416

and let's see "strategy" on yesterday blog,

we order long position to aim 10 to 30 pips afer 8:00.

USD JPY was 92.416 at 8:00 am

and USD JPY rose up to 92.538 at 8:22 am

then we could have 10 pips

next. let's see USD JPY at 10:00 am

according to stratedy, we order short position to aim 10 to 30 pips after 10:00 am.

start price of USD JPY was 92.362 at 10:00 am

then, USD JPY has dropped to 91.62 at present,

we could get 10 pips, moreover 30 pips as well. :)

I do think 10 pips is enough, we could get 30 pips and 70 pips right now.

that's one of trading methods on 5th. 10th, 15th, 20th, 25th each month :)

today's 5th Jan. Let's see how it is going.

8:00 a.m. Japan time:

start price on USD/JPY was 92.416

and let's see "strategy" on yesterday blog,

we order long position to aim 10 to 30 pips afer 8:00.

USD JPY was 92.416 at 8:00 am

and USD JPY rose up to 92.538 at 8:22 am

then we could have 10 pips

next. let's see USD JPY at 10:00 am

according to stratedy, we order short position to aim 10 to 30 pips after 10:00 am.

start price of USD JPY was 92.362 at 10:00 am

then, USD JPY has dropped to 91.62 at present,

we could get 10 pips, moreover 30 pips as well. :)

I do think 10 pips is enough, we could get 30 pips and 70 pips right now.

that's one of trading methods on 5th. 10th, 15th, 20th, 25th each month :)

Monday, January 4, 2010

Trading Method by Short Supply of Telegraphic Transfer Middle rate

TTM = Telegraphic Transfer Middle rate

ex. http://www.hsbc.co.jp/1/2/hsbc-premier/disclaimer/fx_disclaimer

TTM in short supply = Long cross JPY

this is kinda fundamental trading method to entry long position for USD when it is in the morning before around 10'clock (Japan time) on 5th 10th 15th 20th 25th each month, because TTM are in short supply.

Strategy:

in the morning on 5th 10th 15th 20th and 25th each month

8 a.m. - 10 a.m. (Japan time) Long USD to aim 10 pips to 30 pips

after 10a.m.Short USD to aim 10 pips to 30 pips

if TTM is in short supply on 20th 30th = Watch out for Long USD

Watch out if it is down trend

Check news all time to know how many number of TTM in the market.

tomorrow will be 5th Jan. Good luck for trade :)

ex. http://www.hsbc.co.jp/1/2/hsbc-premier/disclaimer/fx_disclaimer

TTM in short supply = Long cross JPY

this is kinda fundamental trading method to entry long position for USD when it is in the morning before around 10'clock (Japan time) on 5th 10th 15th 20th 25th each month, because TTM are in short supply.

Strategy:

in the morning on 5th 10th 15th 20th and 25th each month

8 a.m. - 10 a.m. (Japan time) Long USD to aim 10 pips to 30 pips

after 10a.m.Short USD to aim 10 pips to 30 pips

if TTM is in short supply on 20th 30th = Watch out for Long USD

Watch out if it is down trend

Check news all time to know how many number of TTM in the market.

tomorrow will be 5th Jan. Good luck for trade :)

Sunday, January 3, 2010

Swing Trade with Carry, Momentum, and Value trade method.

Swing Trade using those;

1. Carry Trade = Buy the highest interest currency and Sell the lowest currency2. Momentum Trade = Buy the highest return currency and Sell the lowest return currency.

3. Value trade = According to "PPP", Buy the lowest currency, and sell the highest one.

Leverage: less than 10

Trade: middle to long term trading method

Currency: USD/JPY, AUD/JPY, EUR/JPY, GBP/JPY, and CAD/JPY

This is for Swing Trade, so please do back test, and please find the best TC and LC, but if it is wrong, please do not trade, it is not time to trade in this case.

Please do risk management with low leverage.

Good luck for trade :)

This is for Swing Trade, so please do back test, and please find the best TC and LC, but if it is wrong, please do not trade, it is not time to trade in this case.

Please do risk management with low leverage.

Good luck for trade :)

Saturday, January 2, 2010

Support and Resistance.mq4 trading method.

Support and Resistance.mq4

MT4 indicator for breakout or TC,.

It can be good to use with MACD and stochastic.

Good luck for your trade. :)

I will be back to Market and trade from Jan 18th in 2010. :)

This year is important to see next 3to 5 years. We can do the best. :)

MT4 indicator for breakout or TC,.

It can be good to use with MACD and stochastic.

Good luck for your trade. :)

I will be back to Market and trade from Jan 18th in 2010. :)

This year is important to see next 3to 5 years. We can do the best. :)

Friday, January 1, 2010

scalping for USD/JPY method

USDJPY scalping method

MT4: mt4bbtpl.lzh

Trading: Scalping

Currency: USD/JPY

Chart: 1min and 5mins Candle

MT4: mt4bbtpl.lzh

Trading: Scalping

Currency: USD/JPY

Chart: 1min and 5mins Candle

Subscribe to:

Posts (Atom)